A token is a right of return

The basic tools of modern token design can be traced back to the goal of reducing the speed of practical tokens. While governance capacity creates a more compelling reason to hold utility tokens, many of these tokens still strive to accumulate value effectively and lack mechanisms to preserve value in irrational market behavior. As a result, there is a growing consensus within the web 3 community that tokens must begin to provide a share of revenue as well as governance.

Notably, tokens that provide income-sharing to holders may make them look more like securities. While many will use this to argue against DEFI tokens providing a share of revenues, it is also true that DeFi as a whole will continue to exist as a mass speculative market unless such a change occurs. If DeFi were to gain mainstream legitimacy, then it would be unacceptable for all token price movements to experience near-perfect positive correlations, in which case, the different levels of profitability of the agreement are not reflected in the token price movement. While there is an obvious concern that the transition to tokens as income rights may increase their security-like attributes, it is considered preferable to consider a long-term path in which tokens remain merely governance rights, this is misleading.

As DeFi Man concludes in his article, there are two main ways tokens can be paid today:

- Buy the native agreement tokens from the market and (1) distribute them to the holder, (2) burn them, or (3) keep them in the warehouse of the agreement.

- Redistribute the proceeds of the agreement to the holders of the tokens

Yearn. Finance made waves in December when it announced plans to update its tokens economic model and issue buy-backs. As a result, YFI prices have rebounded 85% in the short term. Although this is only a temporary surge, the strong desire for a better value-added token model is obvious. In the long run, however, the share of income from distribution agreements is clearly superior to token repurchase. The primary goal of any DAO should be to maximize the value of long-term tokens holders. As Hasu writes, “Every dollar that a protocol owns or receives as income should be allocated to its most beneficial use (in today’s money) .”. Therefore, Dao is optimal only if its native tokens are undervalued.

- EVM Deep Dive Part 1

- 120 Charts: the state of Web3 and digital assets as of Q4 2022

- How is the development of the Cosmos ecosystem, which is as popular as Ethereum?

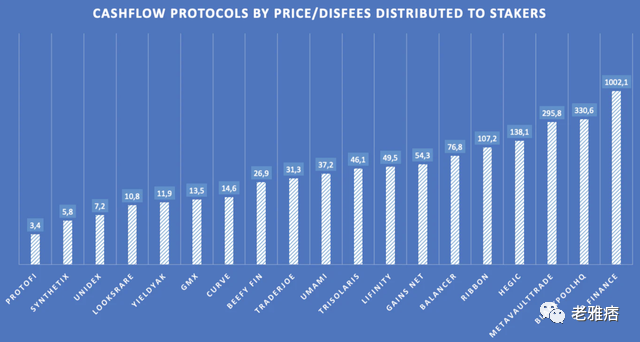

An agreement for their holders to adopt a share of income creates measurable cash flows, making possible a standard valuation framework that applies to all tokens. The valuation of tokens by means of income paid to holders of tokens also requires a reassessment of income paid to liquidity providers. A common approach to analyzing revenue generated by protocols is to divide revenue into two categories: protocol and LP. Assessing the value of tokens through the income allocated to tokens holders exposes the true face of LP income as an operating cost.

A growing number of agreements have begun to establish revenue-sharing with governing tokens. GMX, in particular, has set a new precedent. Against this background, GMX is a zero-slip, decentralized Avalanche and Arbitrum permanent futures and spot exchange. GMX subscribers get 30% of the agreement fee, while LPs gets the other 70% . Fees are paid in $eth and $avax instead of $gmx. Similar to growth stocks that retain their earnings rather than pay dividends, many argue that paying tokens holders a fee rather than reinvesting them in an agreement’s coffers, this is not conducive to the long-term development of the agreement itself. GMX, however, shows that this is not the case. Despite sharing revenue with tokens holders, GMX continues to innovate and develop new products such as the X 4 and PvP Amm.

In general, reinvestment makes sense only if an agreement or company is able to make better use of the accumulated funds rather than allocating them to stakeholders. Daos tend to be less efficient at managing capital and have a decentralized network of contributors outside their core team. For these two reasons, most daos should be able to distribute revenue to stakeholders earlier than their centralized, Web2 peers.

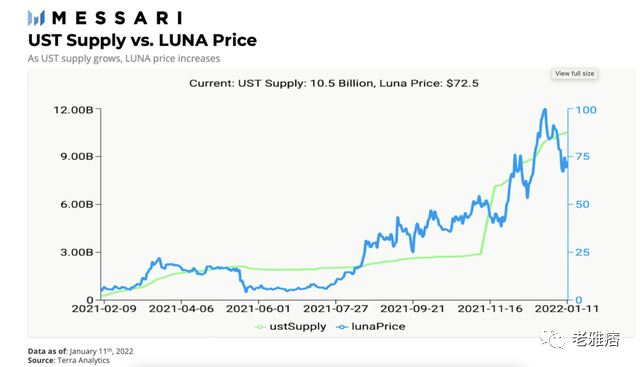

Learn from the past: Burn and pledge

While Terra’s collapse is harmful, it is highly educational and offers many insights into shaping the future of sustainable token models. In the short term, Terra has proven that burning tokens is an effective way to accumulate and capture value. Of course, however, this didn’t last long. In manipulating the $Luna Burn rate through Anchor Protocol, Terra caused an unwarranted and unsustainable decrease in the $Luna supply. While supply manipulation lit the fuse of self-destruction, Terra’s collapse was ultimately due to how easy it was to expand the supply of $Luna, even after a series of supply contractions.

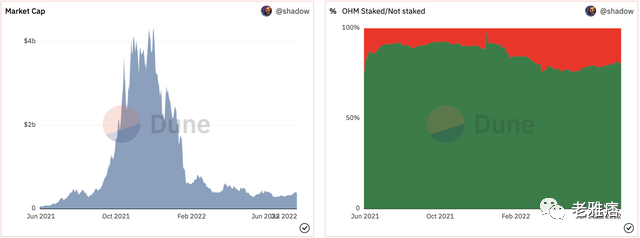

(3,3) economics of Tokens

At the bottom of the 2021, (3,3) the decline of game theory also has many implications. Olympus DAO demonstrated that pledging a large portion of an agreement’s native tokens can contribute to a significant increase in the price of short-term tokens. However, we have since learned that if the pledgee is allowed to withdraw at any time with minimal impact, they will do so at the expense of other pledgers.

Rebases are implemented to actively strengthen pledges. If a user takes a stake, he or she gets“Free” tokens to maintain his or her current market share. In reality, anyone who wants to sell doesn’t care about being diluted on release. Because of the nature of rebases, first-in and first-out regulars profit by using new people as their exit liquidity. In order to implement sustainable dividends in the future, it is necessary to impose more severe penalties on those who cancel dividends. In addition, those who release the pledge later should benefit more than those who release it earlier.

VE token economics

The common theme of all previous failed token models is their lack of sustainability. One widely used token model that attempts to increase token value accumulation sustainably is the Curve VE model. The model seeks to implement a more sustainable pledge regime by providing tokens holders with incentives to lock up their tokens for up to four years in exchange for inflationary incentives and increased governance powers. While ve works well in the short term, there are two main problems with this model:

- Inflation is an indirect tax on all holders of tokens and has a negative impact on the accumulation of tokens’ value

- When these lock-ups eventually expire, there could be a massive sell-off.

When VE is compared with (3,3) , these models have a similarity in that they both provide an inflationary incentive in exchange for the token holder’s commitment. The lock-up period acts as a short-term brake on selling pressure, but once the inflation incentive becomes less valuable over time, and the lock-up period expires, there is a lot of selling. In a sense, ve is comparable to time-locked fluid mining.

The ideal token model

Unlike the unstable tokens of the past, the ideal tokens of the future will sustainably adjust incentives for users, investors and founders. When yearn. When Finance’s ve-based tokens economics project (Yip-65) was proposed, they claimed to have built their models around several key motivations, some of which could be applied to other projects:

- Implementing token repurchase (the payment of income to the holders of tokens)

- Build a sustainable ecosystem

- Motivate a long-term view of the project

- Disproportionately reward those who are most loyal

With these principles in mind, I propose a new tokens model that seeks to provide stability and value accumulation through taxation.

Income and tax patterns

I have determined previously that an ideal tokens design would entitle the holder to a governance and a share of the agreed income upon pledge. In this mode, the user must pay a“Tax” to unlock, not a period of time. While unlocking taxes/penalties is not unique to this model, the mechanism for taxation is. The unlocking tax that users must pay is determined by a percentage of the number of tokens they pledge. Some of the taxing tokens will be distributed proportionately to the other policyholders in the pool, while the other portion will be burned. For example, if a user bet 100 tokens, the tax rate is 15% , they will spend 15 tokens to release the pledge. In this case, if the user chooses to release, the 23 tax (10 tokens) will be distributed proportionately to the other policyholders in the pool, while the 11/3 tax (5 tokens) will be burned.

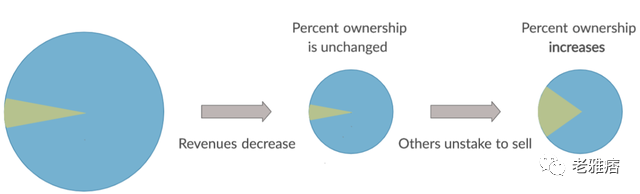

The system rewards the most loyal users disproportionately. Holders of tokens who stay longer than their peers benefit the most. It also reduced the downside volatility during the sell-off. In theory, if someone releases the pledge, it is because income has declined or is expected to decline in the near future. A decrease in revenue can be seen as a decrease in the overall pie, when the agreement revenue is viewed as a pie. In the preceding example, taxing tokens distributed to those who are still pledged increases their slice of the pie and reduces their losses.

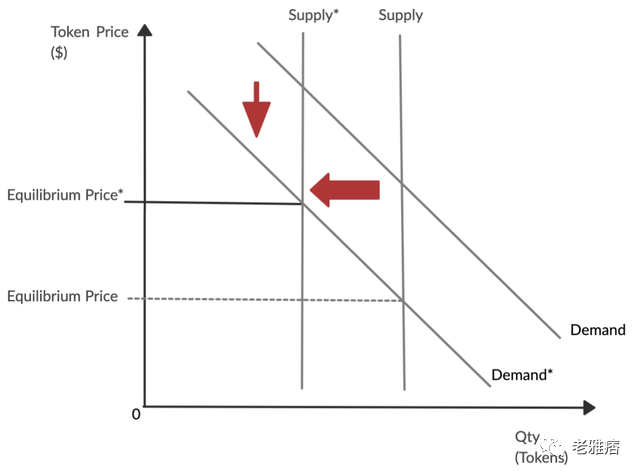

A flaming 11/3 tax would put deflationary pressure on the token supply, raising the overall token price. In the long run, burning will drive the token supply to follow a pattern of exponential decay. The top chart shows how losses might have been mitigated if holders had held on during the market sell-off, while the bottom chart shows how the burning tax portion reduced losses for all tokens holders, whether it is held or not.

The graph reflects the inward shift in demand for tokens as a result of reduced agreement revenues. As a result, some investors have released their tokens for sale. Some of their tokens were burned during the release of the pledge. The burning mechanism of taxation reduces the total token supply and shifts the supply curve to the left. The result is a smaller decline in the price of tokens.

The worst of this pattern could happen if agreement revenues plummet and the whales decide to release their pledges and sell their tokens. Given Convex currently controls 50% of all VECRV, this could mean half of the tokens are released and sold. If most tokens are pledged before the sell-off, even with taxes, it will inevitably collapse in tokens prices in the short term. This underscores the fact that no matter what pledge/burn mechanism an agreement may implement, tokens remain worthless if the underlying agreement does not generate revenue. Suppose, however, that in this example, agreement revenues rebound in the near future. Those who remain pledged after the whale sell-off will receive 5 per cent of the total token supply, which will be reduced by 2.5 per cent, significantly increasing their share of future income.

Since the whale boom is inevitable, further refinements to the proposed tax could be a progressive tax. While progressive taxes may prove difficult to implement, agreements may be enforced using analytical tools, such as Chainalysis, or by building their own internal tools. It is hard to say what the best solution for progressive taxation would be. Clearly, more research and development is needed to answer this question. We look forward to any future research that clarifies this issue.

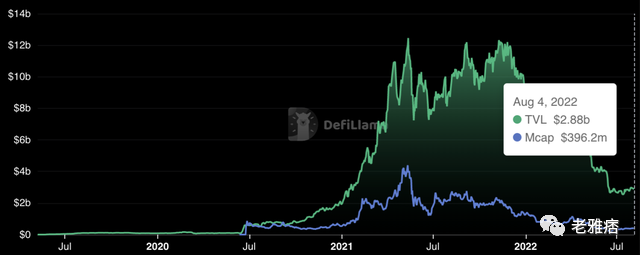

Whether it is a flat or progressive tax, each agreement should not adopt this revenue-sharing and tax model until it has amassed a significant amount of TVL. At the beginning of an agreement’s life cycle, priority should be given to channelling liquidity, diversifying its tokens, and building market traction. Because of this, the token model built around liquidity mining in the early stages of the development of the agreement may have a positive effect on its long-term development. However, as the agreement matures, its priorities must shift from guiding the TVL to creating long-term, sustainable token value accumulation. Therefore, it must adopt different token models to better integrate economic incentives with new goals. Compound is an example of a protocol that does not change its token design to meet its maturity stage. Despite accumulating a lot of TVL and generating a lot of revenue, this value creation is rarely realized by $comp holders. In an ideal world, the profitability of an agreement would be reflected in its token price, however, only occasionally.

Compound TVL + market cap

Conclusive thinking

The most important aspect of the proposed token model is that it is sustainable. Pledge incentives are more sustainable because they Favour first-in, first-out rather than the typical first-in, first-out accounting principle. The token burning element in the design is more sustainable because it is unidirectional (supply can only contract) . If there is anything to be learned from the recent market downturn, it is that sustainability matters. While the path of Web3 will be led by disruptive innovation and increased user adoption, none of this will be possible without a more sustainable token model that effectively accumulates and retains value.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!