There has been a massive slowdown in the web 3.0 space.

For most investors, web 3.0 games are a publicity stunt. They are more concerned about return on investment and less concerned about the actual delivery of game products to players. The medium-and long-term operation of the game is not guaranteed, this year’s experience with various web 3.0 games proves it.

In this article, you’ll find out whether web 3.0 games can be turned into healthy ones? How to break through the current difficulties and achieve a longer-term development? What are the three possible forms of the future? This post was written by Javier Barnes and posted on the deconstructoroffun blog.

Two big challenges for web 3.0 games

According to Javier Barnes, there are two major challenges to turning web 3.0 games from a gimmick into a truly sustainable product.

First, most L1 cryptocurrencies are unstable, especially the“Crypto-whales,” which, once they generate large-scale fluctuations in value, have the potential to disrupt the entire system built on top of them.

Almost all web 3.0 games today are losing money because of factors beyond their control, reducing player activity and failing to attract new users. In the short term, this directly affects other companies in the field, and in the long term, it means that the underlying ecosystem of the game is not sustainable.

Web 3.0 gamers are most concerned about the value of their in-game assets, but when the chain is unstable, panic can drive players out of the game en masse, how can developers maintain player interest even as the value of L1 cryptocurrency assets declines?

There are some optimized L1 public chains that reduce the cost of the game for players, increase the speed of verification, and stabilize the currency value.

But they have two problems: one, there are almost no big web 3.0 games on the chain; and two, because most“Crypto whales” rely on the“Non-game” chain to accumulate assets, moving to the new chain will involve complex bridging systems, so such optimized L1 public chains will lack high-value“Whales” and many WEB3 gamers.

The second challenge is that most web 3.0 players will choose games based on their expected value growth, and as long as that’s the case, the“Quality Games” chosen by the market are those that sacrifice long-term growth for short-term growth.

According to Javier Barnes, “(economic) problems” such as PvE-centric, in-game inflation, and high barriers to entry undermine the game’s long-term development, and they encourage and accelerate speculation, provides players with a higher short-term (unsustainable) return on investment.

But they just happen to be the catalysts for the rapid growth of web 3.0 games, so designers can’t fix these problems.

After all, once fixed, the game loses its appeal to the player.

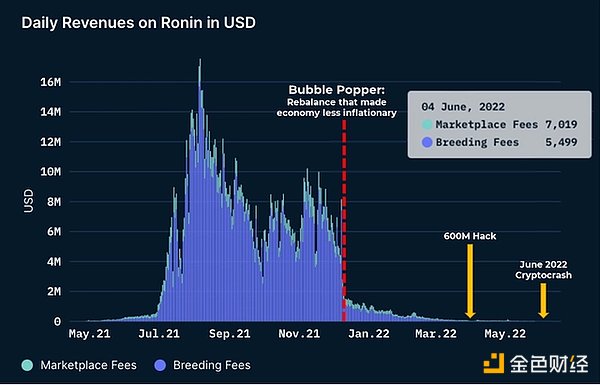

One of GameFi’s signature products, Axie Infinity, is just that. Game design is supposed to be long-term, but as the economics of the game continue to unravel, revenues continue to decline, causing a mass exodus of players and value, earnings for players who remain in the game have also been affected, with daily revenues falling from an average of $8m to just $10,000 and active accounts dropping from a peak of $1m to about $50,000.

However, with so much value still frozen in the game, Axie Infinity may be able to make a comeback.

But if sustainability is to be considered, games need to at least move away from the old, passive“Play to Earn” model and promote in-game competition through deeper systems of upgrades and collections.

How can web 3.0 games be sustainable?

Some might argue that these problems can be solved by reforming the in-game economy and management, for example, by increasing the window time for players to cash out, so that even if the value fluctuates, players are not free to leave. Add, for example, a deflationary mechanism that limits potential speculation.

In Javier Barnes’ view, these solutions are“Band-aids”, as they are made after the economic problems have been exposed, rather than trying to stop the“Bubble” at its source, you Can’t keep the players.

If players entered the game primarily to speculate on the value of assets, then the economic design and blockchain design in the game would not matter, and a bubble would certainly emerge.

In other words, at the heart of the web 3.0 game sustainability issue is the inability to meet player expectations for positive sum games. There can’t be a game where most players“Make money” or“Play to Earn” from the game alone. The money has to come from somewhere. From an economic point of view, every game ends up being a negative sum, considering the system as a whole.

Of course, if you just think about Play to Earn, in some games, under certain conditions, for certain players, it can be positive-sum, the“Black Market” of EVE Online and the“Gold retailers” of World of Warcraft, for example, are minor (and sometimes parasitic) elements of much of the gaming economy and community.

In games with Play to Earn content, the vast majority of players spend more than they Earn, and they can live with that, because they’re not in the game for pure gain, they’re paying for the experience.

Obviously, this is not what most web 3.0 gamers expect.

So, Javier Barnes says, for web 3.0 games to be sustainable, they need to make the 180-degree turn: from a game where“Players come here to make money,” to a game where“Players come here to spend money and have fun.” That way, even if the asset value drops, the player won’t sell or give up the game because they don’t care about the asset value.

In that case, games may lose much of the appeal of the web 3.0 concept and face a different audience, so we need to seriously re-evaluate the future of web 3.0 games as an emerging market.

The idea behind Javier Barnes is that the early adopters of web 3.0 games aren’t really players, they’re actually crowdfunding game development investors, helping the team create a game for a pure game audience, and profit from the future development of the game.

But there are still problems with this idea.

The biggest problem is that, due to the lack of regulation, such investment activities tend to encourage false speculation and other bad behavior. Second, investors are not necessarily interested in the actual profitability of the game, but only in the price movements of the game assets (tokens, NFT, etc.) , which means that when the prices of these assets rise, most of them are likely to dump and collapse in value.

So while the idea is sound in theory, there are still many problems in practice, especially given the current lack of market regulation in web 3.0.

Three models for the future of web 3.0 gaming

According to Javier Barnes, there are currently three games that are most likely to be the next wave of web 3.0 games and will be sustainable. The first is a game of chance.

Poker, slots, and other game genres already have the premise of“Play to Earn,” although it’s well known that only a small number of players can actually“Earn.”. For most players, the main reason they come to the game is to have an interesting and exciting gaming experience.

Using blockchain technology, these games can more easily integrate complex RPG, upgrade, and trading systems to make them more interesting than comparable games, such as those inspired by simulated horse racing or racing games. The problem, of course, is that the game, which is relatively niche and whale-oriented, is more controversial than other Casino branches, but also more subject to government regulation.

But given the aforementioned“Game-oriented” goal, these types of games are more likely to succeed.

The second is UGC (Content Creators and Spenders) , which may be how platforms like Roblox or TikTok will play in the Web 3.0 space. It should be noted that UGC is the content creator (e.g. Roblox developers, TikTok content creators) that inspires in-game pay, rather than content providers who act as “Middlemen” between the consumer and the product (players of Axie, Jin Nong of World of Warcraft, landowners of virtual worlds, etc.) .

For example, Roblox’s UGC generates content that players want to play and pay for, Tiktoker makes users want to stay in the app longer and generate advertising revenue, while AXIE players simply sell their gaming assets to others, content is provided by game developers, players are just“Extract” this content. So the UGC itself is an important asset for the product/platform.

The problem then is that creating such a web 3.0 platform is much more difficult than developing an ordinary game. The main difficulty is not the technology, but how to get users involved? After all, such a platform can only provide enough motivation for content creators if it has a large number of users who are willing to consume the content.

If it works, it will be a winner-takes-all system because of the huge investment risks, the limited size of web 3.0 and the high barriers to entry, so there won’t be a lot of competition.

Finally, there’s“Play and Own,” where the player comes in for gameplay and also owns game assets.

In short, “Play and Own” is a way to avoid value bubbles by eliminating entry-level price speculation, to escape the inflationary economy, and to escape players’ expectations of profits, the transaction of resources as the core activity in the game to activate the user.

Through a strong user focus on transactions and ownership, encouraging teamwork, creating complex economic and social structures, and ultimately significantly increasing player engagement, similar to what games like Eve Online do. Having a game with the same complex economic system as Eve Online sounds great, but it’s hard to replicate. After all, the collapse of the secondary market means a lot of gaming resources are flowing at low prices, this may eliminate the need for players to engage in in-game activities to obtain resources.

Another example is ImmutableX’s design for games such as Gods Unchained, where blockchain is designed to enhance collectible value and card trading in a CCG game. This is similar to The“Magic: The Gathering or Warhammer” mechanism, where players care about The game but often trade in game assets, such as selling old Space Wolves to get a great Carcharodons.

From the player’s point of view, this form is the most interesting, and the collapse of the secondary market will not have much impact on the core audience. But it is still challenging because these assets are closely related to real value, which means they need to be monitored very closely, and they are harder to manage than regular games.

Conclusion

Perhaps the biggest problem is that the current web 3.0 game audience is very limited, and this segment of players is chasing short-term revenue, so the fundamentals of web 3.0 games cannot grow much better, the problem is reinforced by fluctuations in value.

“Blockchain games tend to explode, so try to hit the jackpot and move to the next one!”.a paradigm reinforced by the volatility of the Web3 space

Javier Barnes

Thus, Javier Barnes is pessimistic about the future of Web3 gaming as a whole, and it is highly likely that existing problems will remain unresolved in the future, with games likely to promote short-term growth at the expense of long-term growth in the short term.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!