Author: MiddleX

Recently, from BRC20 to ORC20, from “Wizards” to “Frog Pepe”, the memes of the Bitcoin ecosystem have risen and impressed the market, making it completely FOMO. At the same time, besides the Ordinals protocol, the forgotten Bitcoin inscription protocol RGB, and various Bitcoin L2 projects have become new hotspots, and some new projects have also entered, hoping to participate in building the Bitcoin ecosystem and share in the new narrative.

What is the technical essence of “inscriptions” on Bitcoin, is it inscribed on “Satoshi”? What is Bitcoin L2? Can an ecosystem be built on Bitcoin? Let’s take a look.

- Inventory of 10 emerging projects with powerful catalysts: Vela Exchange, Florence, Chronos…

- Hong Kong’s new regulations on virtual assets will take effect on June 1st, and individual investors may enter the market as early as the second half of the year.

- Hong Kong lawyers interpret new regulations on virtual asset trading from six aspects

What is Bitcoin “Inscription”

Bitcoin is a decentralized ledger that records every transaction that occurs in it. When each transaction is submitted, the Bitcoin network allows for the submission of a custom string of characters, which can be understood as a transaction note. This transaction note field was mainly the “OP_Return” field in the past, and after the Taproot upgrade, it can also be the transaction witness field. Regardless of where it exists, this part is stored as part of the transaction on the Bitcoin chain.

So what’s the deal with inscribing on “Satoshi”? In fact, the Ordinal protocol was originally used to issue NFTs. In the process of minting Ordinal NFT, you will receive 1 satoshi, and the metadata of the NFT is inscribed on the transaction that carries the 1 satoshi, so the 1 satoshi is bound to the NFT. If you are willing to pay a higher cost, you can also inscribe the complete data of the NFT, and the witness field supports up to 4M of content to be inscribed.

But please note that the Bitcoin network does not recognize the binding relationship between Ordinals NFT and satoshis. When you transfer this 1 satoshi to someone else, the Bitcoin network does not distinguish whether this is a bound NFT satoshi or a normal satoshi. This means that you may accidentally pay off this special satoshi when you transfer it.

As we all know, Bitcoin’s ledger is a UTXO model, which is a ledger model that simulates physical cash. What is stored in each person’s account is not Bitcoin, but individual UTXOs, like individual banknotes. When you need to pay someone else, if you have multiple banknotes in your account, you can choose which banknote to use (self-selected UTXO). In addition, you can use a banknote to pay for a transaction, or you can use multiple banknotes to pay for a transaction. If the amount you want to pay is less than the minimum banknote amount you have, you can also split the banknote in half, paying one to the other and one to yourself (this is commonly referred to as “change” in the UTXO model).

Most Bitcoin wallets do not prominently feature the option to select UTXOs when making payments; instead, this option is usually hidden within advanced settings. By default, the wallet will automatically select which UTXOs to use for payment based on a set of random rules defined by the wallet itself.

To avoid accidentally spending special satoshis as if they were normal satoshis, “client-side validation” is required. If the wallet supports the Ordinals protocol, it will avoid spending special satoshis when making a payment. If you try to transfer one of these special satoshis, the wallet will also prompt you that you are transferring an NFT. This means that wallets that support the Ordinals protocol are responsible for maintaining and recognizing the binding relationship between NFTs and special satoshis.

The RGB and Ordinals NFTs work in the same way, using client-side validation to verify the binding relationship between NFTs and satoshis. This is essentially a form of off-chain consensus.

Are BRC20 tokens inscribed on “satoshis”?

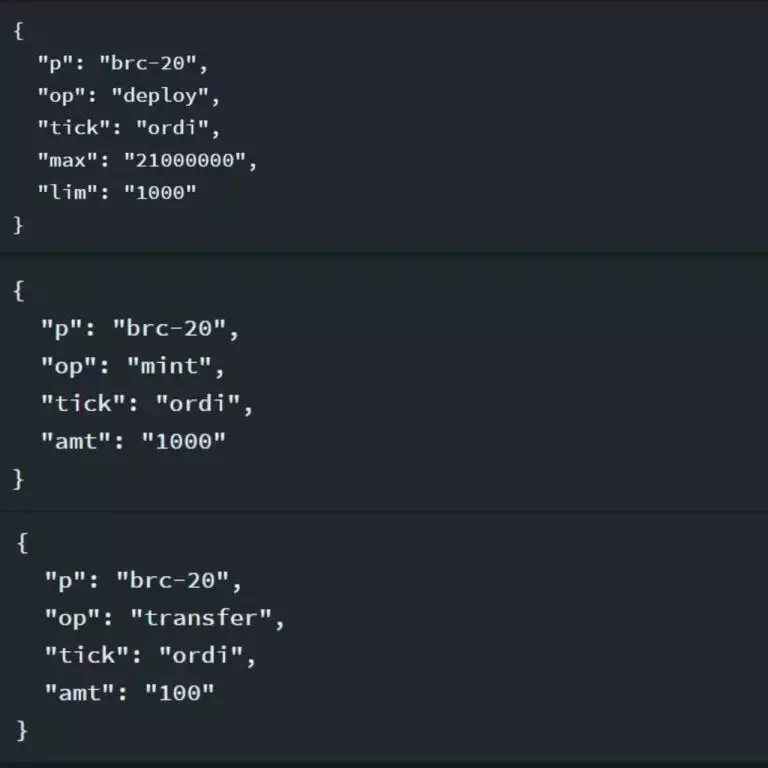

Both Ordinals NFTs and BRC20 tokens are essentially inscribed in Bitcoin transactions, not on “satoshis”, with the exception that Ordinals NFTs establish a binding relationship between NFTs and satoshis. BRC20 tokens, on the other hand, are deployed, minted, transferred, and so on through inscriptions. Specifically, this is achieved by writing state transition data in Jason format into Bitcoin transactions, as shown below:

Anyone can inscribe on the Bitcoin chain, not necessarily through a specific client. If someone mints BRC20 tokens that have already been minted through inscription, or transfers BRC20 tokens they do not actually own, these minting or transfer transactions will be invalid. However, the Bitcoin chain itself does not process this code, nor does it verify whether BRC20 token minting or transfers are valid.

Validation of the validity of inscriptions is performed by wallet clients or browsers that support the Ordinals protocol.

One way to understand this is that the Ordinals protocol effectively treats the Bitcoin protocol as a hard drive and records its own ledger on the Bitcoin chain, but the interpretation rules for the ledger are local, not on the Bitcoin chain. Alternatively, we can use the modular blockchain approach to understand that the Bitcoin chain is only the data accessibility layer of BRC20 tokens, and the Ordinals protocol itself is the true consensus layer. This logic is similar to the concept of “sovereign Rollup” proposed by Celestia.

The difference between BRC20 and Ordinals NFT is that the transfer of Ordinals NFT is not implemented through inscriptions, and transfer functions are not needed. To transfer the corresponding NFT, only a specific satoshi needs to be transferred. This structure is naturally compatible with the Lightning Network. BRC20 tokens are not bound to satoshis and record transfer information through inscriptions, requiring specific compatibility development to support the Lightning Network.

Is the “Inscription” token secure?

Whether it is Ordinals NFT or BRC20 tokens, although the ledger exists on Bitcoin, the consensus rules are off-chain. Therefore, “Inscription”-style tokens do not fully share security with Bitcoin.

As a data availability layer, the Bitcoin chain does not verify inscriptions. Both valid and invalid inscriptions will be submitted. The Bitcoin chain itself does not have the ability to distinguish whether inscriptions are valid. Therefore, although the account book of the Ordinals protocol is stored on Bitcoin, it is a “dirty account book”. All valid data is stored on it, but not all stored data is valid. The filtering of the “dirty account book” is completed through “client verification”.

The “filtering rules”, or the “interpretation rules” of the validity of on-chain data, are the essence of the Ordinals protocol. Only when this set of rules defined by the Ordinals protocol has strong social consensus, are “Inscription”-style tokens safe.

Can an ecosystem be built on Bitcoin?

Currently, the Ordinals protocol can only be used to issue tokens. However, if Ordinals makes the inscription system, that is, the rule system, complex enough, it can be used for DeFi. If Ordinals takes the complexity of the rules to the extreme, and even makes itself Turing-complete, it can implement any contract logic.

But I don’t think this is the Bitcoin ecosystem! This is only the Ordinals ecosystem. If other inscription systems, such as RGB, also make such a set of rules, it is the RGB ecosystem, not the Bitcoin ecosystem. The RGB ecosystem and the Ordinals ecosystem are not interoperable and cannot rely on Bitcoin to provide interoperability. This feels like a contract on Ethereum that cannot access and call another contract…

What is Bitcoin L2?

First, we need to define L2, which refers to chains that attach security to other L1 chains. Bitcoin L2 attaches security to Bitcoin, or Bitcoin L2 is a chain that shares security with Bitcoin.

If we use this standard, Rootstock, Liquid, and Stack are not Bitcoin L2, but can only be regarded as Bitcoin sidechains. Stack claims to implement shared security with Bitcoin in the next version update, but has not disclosed specific plans.

Currently, various fancy proposals claiming to be Bitcoin L2 projects are actually unable to share security with Bitcoin, including:

- Writing the block header on the Bitcoin chain (similar to the Plasma plan that Ethereum has already eliminated)

- Using Bitcoin as a network staking token

- Election of block producers on the Bitcoin chain

- Synchronized block production with the Bitcoin chain

- Incentivizing Bitcoin miners to become L2 network validators

Invalid behavior

If you want to share security with Bitcoin, there is a way. We can imagine, what if the Ordinals protocol not only stores ledger data through inscriptions on the Bitcoin chain, but also puts the entire definition data validity rules (i.e. the source code of the Ordinals protocol) on the Bitcoin chain?

In this case, although “client verification” is still required to achieve verification in the process of a series of operations, any entity can run a clean ledger through the “rules” and dirty ledger written on the chain, and obtain a consistent state transition record and final state.

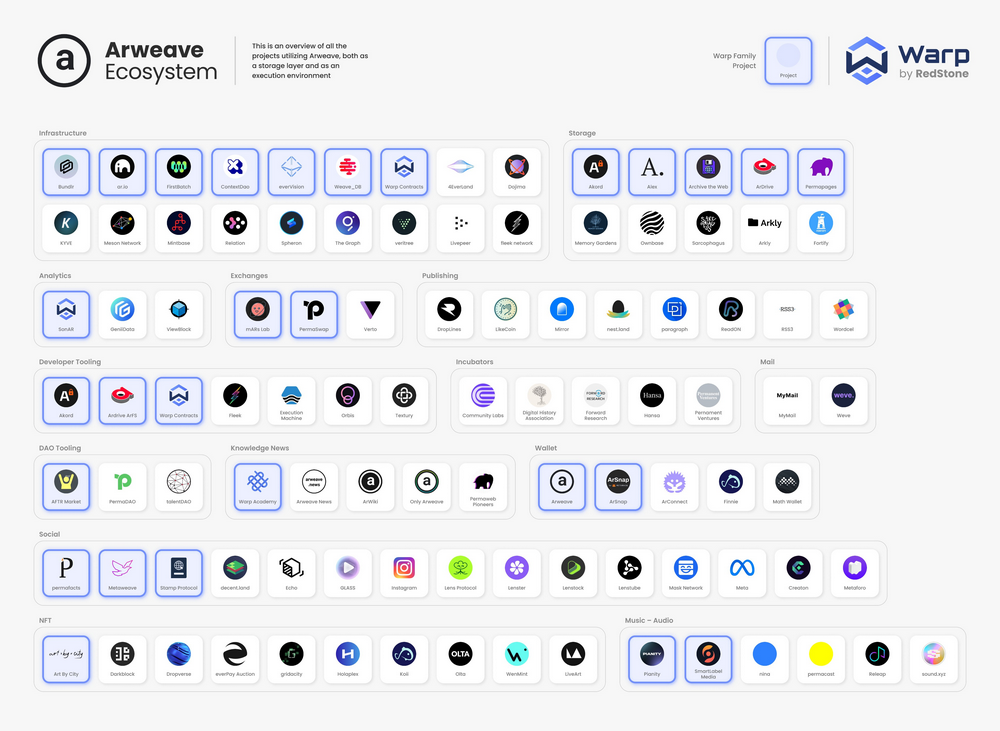

This form is not a new thing, but a storage consensus paradigm proposed by Arweave-SCP. This method is suitable for building heavyweight applications with low interoperability requirements but high performance requirements. Arweave has accumulated for many years and has more than 100 SCP applications.

If you want to build SCP applications based on Bitcoin, it is technically feasible, but economically constrained, and can only build relatively simple applications, because frequent inscription on Bitcoin is not cheap.

Summary

After saying so much, I don’t want to completely deny the efforts to build various services on Bitcoin. I understand the dissatisfaction of PoW supporters with Ethereum upgrades, and I also understand the need for Bitcoin miners to increase their income under the expectation of halving. Of course, the Bitcoin network can use inscriptions to do some meme tokens and collectibles, but the story should stop there. It is not advisable to waste time replicating the Ethereum ecology on Bitcoin (whether it is through “inscription” or L2), because this cannot create any new value for the entire Web3.

Ultimately, building an ecosystem on Bitcoin is like doing something that Ethereum can already do in a more crippled and more expensive way. Nothing new can be created in the Bitcoin ecosystem. I do not deny that the price miracles and wealth myths surrounding the concept of the “Bitcoin ecosystem” may continue, but as a long-termist, I am more concerned with creating actual value, expanding the usage scenarios of Web3, and creating a new narrative that will take Web out of its current circle.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!