Original text: “DVT & Long-Term Ethereum Decentralization” by New Order

Translation by Kate, Marsbit

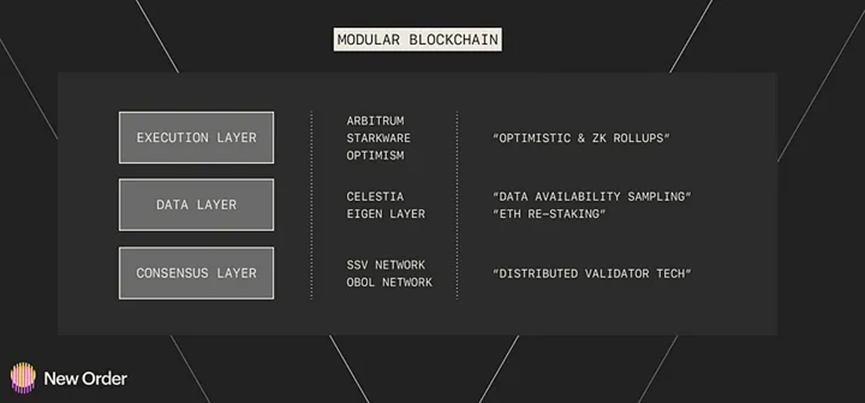

As Ethereum strives for decentralization through scalability, it is becoming increasingly clear that a specialized modular blockchain approach, rather than a singular blockchain approach, is gaining momentum. In this modular blockchain model, one layer can be divided into three layers: the execution layer, the data layer, and the consensus layer. In the execution layer, after several iterations, optimistic and ZK rollups have been developed (such as Optimism, Arbitrum, and Starkware). These advancements have made the execution layer more mature and complete. Therefore, the focus of research has shifted to the next layer, the data layer. An important aspect driving innovation in the data layer is the use of data availability sampling methods, which randomly sample data to ensure the validity of transaction data.

Another critical factor for blockchain is the consensus layer, which includes consensus mechanisms and their scalability. With the launch of the Beacon Chain on September 15, 2022, Ethereum has transitioned from a proof-of-work network to a proof-of-stake network. In the past eight months, the number of validators has increased from 400,000 to 598,000 at the time of writing. The current focus is to make Ethereum’s staking more decentralized, scalable, simpler, more secure, more friendly to independent validators, and less prone to severe penalties. A promising technology in this regard is Distributed Validator Technology (DVT). In this article, we will analyze DVT and explore how it contributes to Ethereum’s decentralization roadmap.

- Wu’s Weekly Picks: Hong Kong to Announce New Rules for Retail Trading, Core PCE Index Exceeds Expectations, Multichain Cross-Chain Abnormalities, and Top 10 News (May 20-26)

- Conflict of opinions, ideological differences? Analyzing the arrogance and prejudice in the Ethereum Black Mountain Conference

- Binance has begun to establish a new fully regulated trading platform in Japan.

Modular Blockchain

ETH Staking Ecosystem

Distributed Validator Technology (DVT) simplifies the process of running Ethereum validators on multiple machines. Before we explore the significance of this technology in decentralized Ethereum validators, it is important to understand the current Ethereum staking architecture.

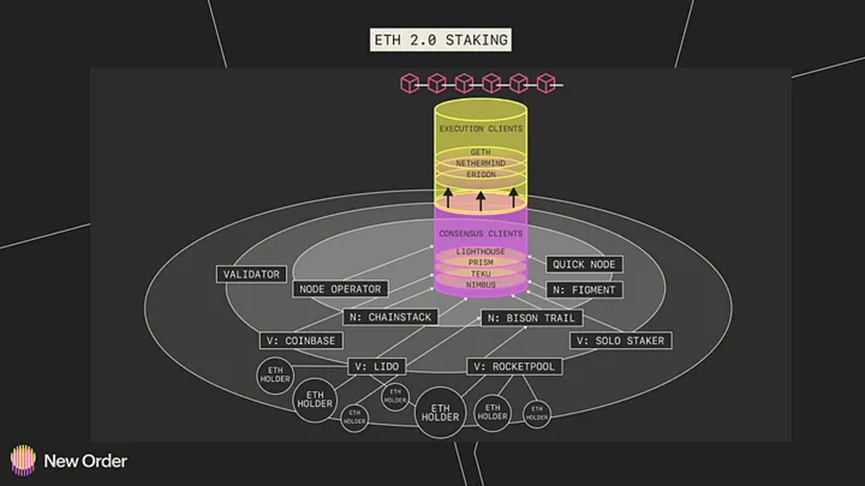

ETH 2.0 Staking

The above figure describes the key stakeholders involved in ETH 2.0 staking and their relationships. In the center of the chart, we use a cylinder to represent the Beacon Chain. The Beacon Chain coordinates the validation process and generates new blocks containing acceptable transactions.

At the core, we have two types of software, typically referred to as ETH2 clients. Consensus clients and execution clients have different roles in adding new blocks. Consensus clients validate and process transactions on the Ethereum network, ensuring consensus among all participating nodes. Execution clients, on the other hand, execute smart contracts and process more complex operations. While they work in collaboration with consensus clients to validate and execute transactions, their primary focus is on implementing the Ethereum Virtual Machine (EVM) that executes smart contract code. Both client types are critical to maintaining the network.

The circles around the cylinder represent node operators who are responsible for running the infrastructure required to participate in the network. This includes hardware, software, and network connectivity. Node operators are responsible for ETH2 clients, maintaining necessary hardware and software, monitoring node performance, and ensuring nodes are running smoothly.

The offshoots next to node operators consist of validators or service providers. As Ethereum holders, we often interact with these service providers. They come in various forms, such as centralized exchanges or staking pools, offering different product designs and capital requirements. The primary value proposition of these validator service providers is convenience. They handle the complexity of staking, including private key management, node operator coordination, and even offering liquid versions of staked assets for decentralized finance (DeFi). They act as asset managers in the Ethereum staking space, introducing funds when necessary and signing transactions.

Alternatively, individuals can choose to connect directly to execution and consensus clients, run required software and hardware, and become independent stakers – the most independent presence in ETH staking.

It is worth noting that the current architecture has multiple links and is susceptible to single points of failure and lacks sufficient decentralization. Issues such as a lack of client diversity, careless private key storage, or node operator failure can result in user funds loss. This is where Distributed Validator Technology (DVT) can add significant value. Let’s take a closer look at the details.

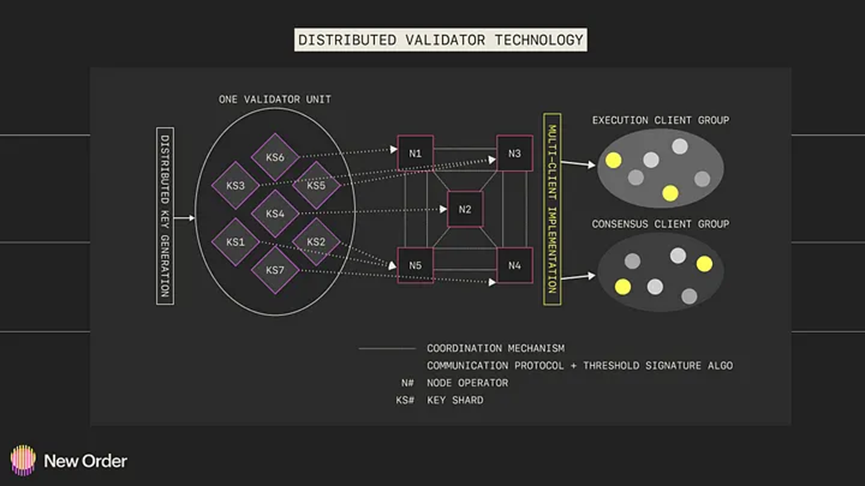

How does DVT work?

Distributed Validator Technology

Distributed Validator Technology (DVT) allows validators to run on multiple machines, which is achieved through various technologies. One key enabler is Distributed Key Generation (DKG), which is a cryptographic process that allows participants to collaboratively generate private keys without any single member having access to the full key. In DKG, each participant generates a partial shard of the private key, which is combined to derive the full private key. This approach ensures that validators do not need to store the entire private key on a single node but can distribute key shards across multiple nodes. Even if a shard or subset of the key goes offline and cannot sign transactions, the remaining key shards remain intact and available for signature. Public Verifiable Secret Sharing (PVSS) and Verifiable Secret Sharing (VSS) are commonly used techniques to ensure the correctness of key generation, with PVSS combining zero-knowledge proofs for public verification.

Once the key sharing is completed and stored across multiple nodes, a coordination mechanism is needed to ensure secure validation and communication between the nodes, ensuring the integrity of signature generation. This coordination constitutes the essence of DVT and can be achieved through various mechanisms, with a common method being threshold signature schemes. In this scheme, a specified number of validators must cooperate to sign a transaction, preventing any single validator from signing alone and enhancing the security of the validation process. In terms of consensus, the SSV network, as a DVT product, uses Byzantine Fault Tolerance (BFT) protocol to achieve signature consensus among nodes.

In addition, DVT must address the problem of sharing infrastructure between nodes responsible for storing key shards. Shared infrastructure may lead to related node failures, thus undermining the decentralization goal. In the SSV network, users can flexibly allocate key shards between different node operators based on factors such as geographical location, different data centers, different data center brands, and different client implementations. This emphasizes the importance of multi-client implementation as a critical component of DVT. Having client diversity is critical to the long-term viability of the Ethereum network, as it reduces the risk of a single client with a majority market share causing forks or other disruptions that could result in validator penalties.

Obol Network is an actively developing DVT company that aims to serve as the infrastructure coordination layer for staking. Their non-custodial middleware, Charon, ensures that the protocol itself does not have custody of the keys. Instead, only the validator clients hold and manage the private keys for signing transactions. Charon acts as an intermediary between the beacon client and validator clients, intercepting communication and aggregating signatures before forwarding them back to the beacon client. This design approach eliminates the protocol’s ability to sign arbitrary data, placing Obol Network in a less controlling role and ensuring higher security. By integrating these technologies and methods, DVT enhances the security, decentralization, and efficiency of the Ethereum validator ecosystem.

Who benefits from DVT?

DVT provides benefits to almost all stakeholders in the staking ecosystem, making it a highly attractive technology. As assets under management (AUM) continue to grow, liquidity staking pools tend to allocate staking to multiple operators rather than relying on a single validator. DVT allows them to share a validator among multiple operators, reducing the vulnerability of assets when a single operator fails.

For independent stakers, DVT puts them at ease by mitigating the impact of internet or power outages. They can continue to validate transactions even during intermittent connectivity or power interruptions. Institutional staking products, such as Coinbase Staking or Blockdaemon, can benefit from DVT by reducing operational and hardware costs. By implementing fault-tolerant solutions like DVT, validators can safely increase the number of keys per node, reducing hardware expenses. Additionally, the risks associated with DVT are reduced, which may lower insurance premiums for service providers. Overall, the wide-ranging benefits of DVT make it an attractive technology for various stakeholders in the staking ecosystem.

One piece of the puzzle

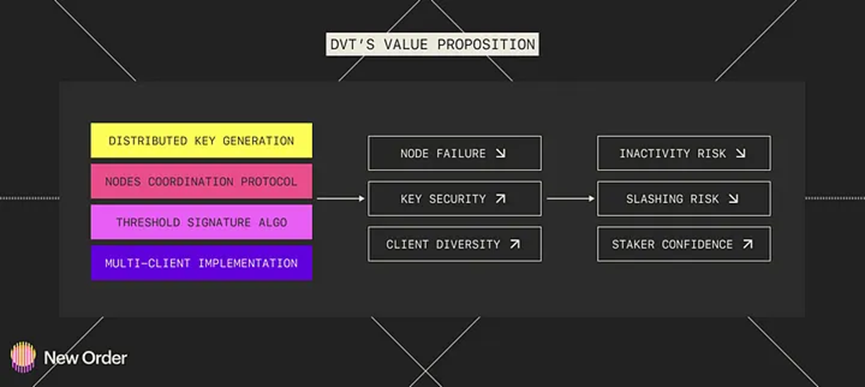

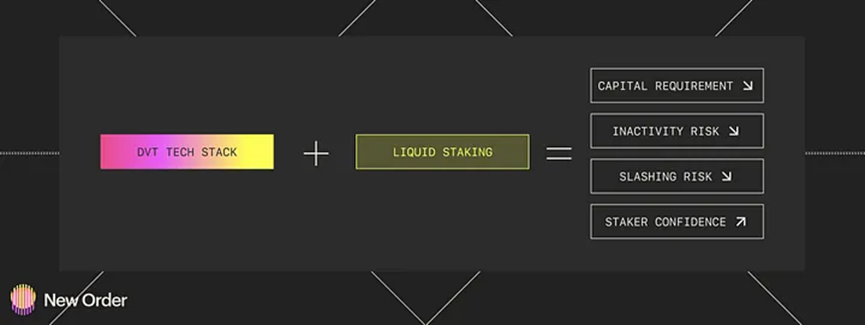

DVT’s value proposition is shown in the following figure:

DVT's value proposition

DVT brings significant value to ETH staking. Its technology reduces the likelihood of node failure, improves key security by distributing keys to multiple node operators, and increases client diversity through product design. This will lower risk, reduce inactive penalties, and increase confidence for stakers. However, this is only one piece of the puzzle. Only by working together with other stakeholders in Figure 1 can the vision of decentralized, scalable, and secure ETH truly be realized.

Combined with liquid staking pools, users are not subject to the requirement of 32 ETH, further lowering the barrier to entry for more people to participate in ETH staking.

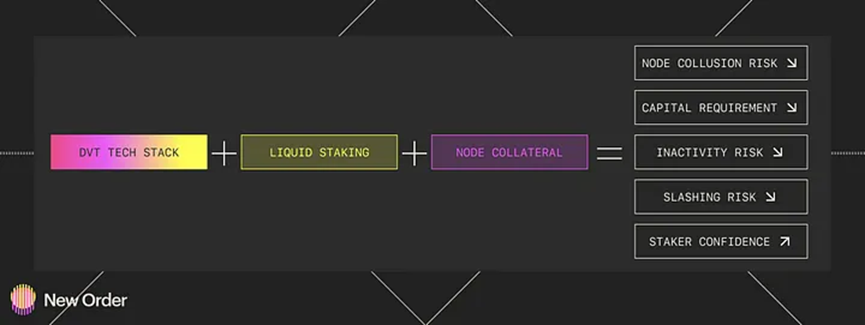

If a staking pool also requires node operators to provide collateral, it reduces the risk of node collusion, as collusion would lead to their own stakes being slashed.

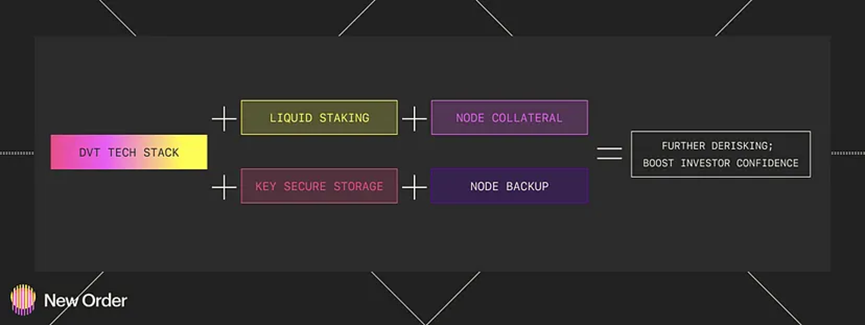

If we add secure key storage using cold storage, multi-signature, or other methods, as well as support for redundant nodes by node operators in case of a failure, it will further reduce risk and increase the confidence of validators. For example, Puffer is a liquid staking pool based on a technology called Secure-Signers. The core idea is to store private keys in a TEE and sign blocks only if the check will not trigger slashing, so operators can guarantee security to stakers. This is an improvement on the node operator side that could be part of DVT. This Secure-Signer supports permissionless participation through remote attestation, which means that unlike Lido, node operators do not need DAO voting and other governance mechanisms to log in. It also claims to lower the staking capital requirement to 1 ETH. It has also created a “smoothing factor” that can be used to evenly distribute MEV rewards to each pool participant. There is not much research on Puffer at present. Whether it can achieve what it claims remains to be further investigated. I also look forward to future technologies that will make Ethereum more secure and reliable, and one day, nothing will keep validators up at night.

Future Challenges

I also want to discuss the challenges that come with adopting DVT. First, DVT involves coordination between multiple nodes, which adds complexity to the system. As mentioned earlier, the SSV network uses a BFT consensus mechanism between nodes. However, the scalability limitation of BFT protocols is that they are designed to handle a limited number of nodes, typically a few hundred at most. Beyond this number, communication and consensus overhead become very expensive, leading to performance degradation and reduced security. If you decide to shard the keys into 100 fragments, this makes applying BFT consensus to large-scale networks challenging. Currently, the key shard limit on the SSV network is 13, and on the Obol network is 10. While this limitation does not pose a direct risk to DVT, it can be further improved.

Similar to the trade-off between decentralization and efficiency, DVT may increase system latency, as transactions must be signed by multiple nodes to be processed. Because the keys are partitioned into many pieces, DVT requires more nodes to participate in the staking process overall, which could increase the requirement for node redundancy. This can be addressed by more investment from node operators. But this also means that the cost for node operators to adopt DVT is too high.

Conclusion

In conclusion, the advent of DVT represents an important step forward for the staking ecosystem. It provides a secure, flexible, and decentralized infrastructure for staking, making it attractive to individual stakers, operators, and staking pools. DVT has the potential to change the staking landscape and become a key participant in future Ethereum staking. With the development of the ecosystem, DVT has the ability to meet the changing needs of stakeholders and drive the development of blockchain technology. I am excited to see the progress of this promising technology and the exciting opportunities it creates for the wider blockchain community.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!