The fallout from the FTX earthquake is spreading across the world. In addition to the known FTX funding gap of $8 billion, affected by the FTX and Alameda-related more than 100 companies, FTX has also been heavy advertising sponsorship and other partnerships have been suspended, it was a thunderstorm on a scale far larger than that of Luna (Terra) and three arrow capital. Once one of the world’s largest exchanges, FTX has users all over the world, particularly in Asia and the US.

The FTX case is known as “Mt.Gox 2.0”, but the Crypto industry is already a global industry, with a far bigger impact than the 2014 collapse of the Mt.Gox exchange, even the Democratic Party of America has lost one of its biggest donors.

The collapse of the FTX has triggered close monitoring by regulators in many countries and regions, especially in the United States. The Regulators in the United States, from the SEC and the CFTC, to the White House and Congress, have all spoken out, a wave of tough regulation of Crypto may be inevitable.

America

The White House:

- Changpeng Zhao: FTX’s near-collapse “severely shakes” confidence in the cryptocurrency industry

- 200 million dollars vanished! Sequoia Capital wrote down its FTX assets to 0, and BlackRock and SoftBank also stepped on the thunder

- Binance abandoned the acquisition of FTX because the capital hole was too large?

The Biden administration is keeping a close eye on the FTX, and the episode highlights the need for better cryptographic regulation. Will continue to monitor the development of cryptocurrencies. The latest news underscores these concerns that cryptocurrencies can hurt ordinary Americans without proper regulation. The White House will not comment on what regulators should do about cryptocurrencies.

US Treasury Secretary Yellen:

The FTX affair shows that we need to regulate cryptocurrencies.

Hester Peirce, a member of the U.S. Securities and Exchange Commission Commission, said:

The collapse of the FTX called on the SEC to act in an effort to provide regulatory transparency.

Gensler, chairman of the U.S. Securities and Exchange Commission Commission, said:

Investors need better protection in cryptocurrencies. Cryptocurrency customers may be queuing up in“Bankruptcy court”. Recent cryptocurrency events have shown that, “Investors get hurt when we don’t rely on time-tested public policy barriers. Part of the cryptocurrency bill breaks securities law. Cryptographic platforms should not be able to authenticate themselves.

U.S. Senator Sherrod Brown, chairman of the Senate Banking, Housing and Urban Affairs Committee:

It is vital that financial regulators study the FTX’s collapse to understand how investors’ money has been abused. The recent collapse of the FTX is a loud wake-up call that cryptocurrencies can fail. The continuing turmoil in cryptocurrency markets is why we must think carefully about how we regulate cryptocurrencies and their role in our economy. In the wake of the FTX collapse, I am committed to finding the best way to protect consumers and the stability of the US market and banking system. Our financial regulators must investigate the causes of the collapse of the FTX so that we can fully understand the misconduct and abuse that occurred.

Maxine Waters, chairman of the House Financial Services Committee:

Federal regulation could have prevented investors from being hurt to this extent. It is now clearer than ever that cryptocurrency entities have significant consequences when they operate without strong federal oversight and customer protection.

Johnson, a member of the Commodity Futures Trading Commission, said:

The FTX affair shows the need for stronger regulation. The CFTC will play a more significant role in regulating encryption.

A spokesman for the Commodity Futures Trading Commission said:

FTX developments are being followed, but no regulatory issues have yet been identified.

United States Representative Patrick McHenry:

FTX and MNA should take measures to protect customers.

US Democratic Senator Warren:

The cryptocurrency industry needs more aggressive enforcement.

Rep. Brad William Tecumseh Sherman, Chairman of the Congressional Subcommittee on Investor Protection and Capital Markets:

A lack of regulatory transparency, partly caused by the SEC, is a key reason why the FTX is in such a sorry state. It is more important than ever that the SEC Act decisively to end the regulatory grey areas in which the industry operates.

US Senator Pattrick Toomey:

The FTX affair underscores the need for a sensible regulatory regime that ensures, among other things, that centralized exchanges segregate and protect client assets.

Japan

Bank of Japan Governor Haruhiko Kuroda:

It is necessary to take prompt regulatory measures to deal with the risk of encrypted assets.

Japanese Finance Minister Shunichi Suzuki:

Will continue to focus on FTX operations in Japan. The plight of FTX’s Japanese parent is deeply regrettable.

Hong Kong

Hong Kong Financial Secretary Paul Chan:

We should steadily promote the development of the virtual assets industry in Hong Kong. “We need to take full advantage of the potential of innovative technologies, but we also need to be careful to guard against the volatility and potential risks that can be created, not to mention the transmission of those risks and impacts to the real economy.”

Europe

Hunter:

We will work closely with regulators on cryptocurrencies.

ECB Supervisory Board President Enria:

The impact of the encryption crisis on the banking sector is negligible.

Can regulation prevent a repeat of the FTX disaster?

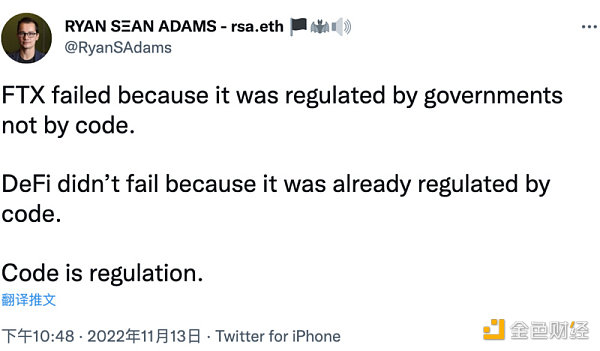

Bankless founder Ryan Sean Adams:

The FTX failed because it was overseen by the government, not the code. DEFI does not fail because it is already overseen by the code. Code is supervision.

Gold supporter Peter Schiff:

More government regulation is not the answer. The lesson of the FTX is to let investors do better due diligence, not to jump foolishly into a speculative frenzy. Moreover, we need a sound currency in which interest rates are set by free markets rather than by central banks.

Shapshift founder Erik Voorhees:

“The glimmer of regulation is very much like the little light at the end of the anglerfish, which attracts not only the hapless victims… but also the politicians, because in its light they see themselves as Saviors.”

COINBASE founder and CEO Brian Armstrong:

It is hoped that U. S. lawmakers will respond to the FTX liquidity crisis by strengthening and leading the global competition to regulate cryptocurrencies. COINBASE has in fact been a strong advocate of regulation in the United States.” Calling on American lawmakers to“Set clear regulations,” the United States is, frankly, a bit behind.

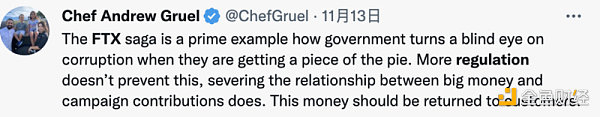

Reality Star Chef Andrew Gruel:

The FTX disaster is a classic example of government turning a blind eye to corruption when it comes to getting a piece of the action. More regulation will not stop this, but severing the link between big money and campaign contributions can. The money should be refunded to the client.

Encryption Guru dciinvestor.eth:

I’m ready for winter, which is as bad or worse than the post-Mt Gox period. The last shoes will soon hit the ground. The regulatory chilliness may last longer, but the day-to-day users who see ads and sign up for FTX and end up losing everything aren’t coming back.

Do you think the FTX thunderstorms were caused by a lack of oversight? Can strict regulation prevent such tragedies from happening again?

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!