Highlights of this Issue

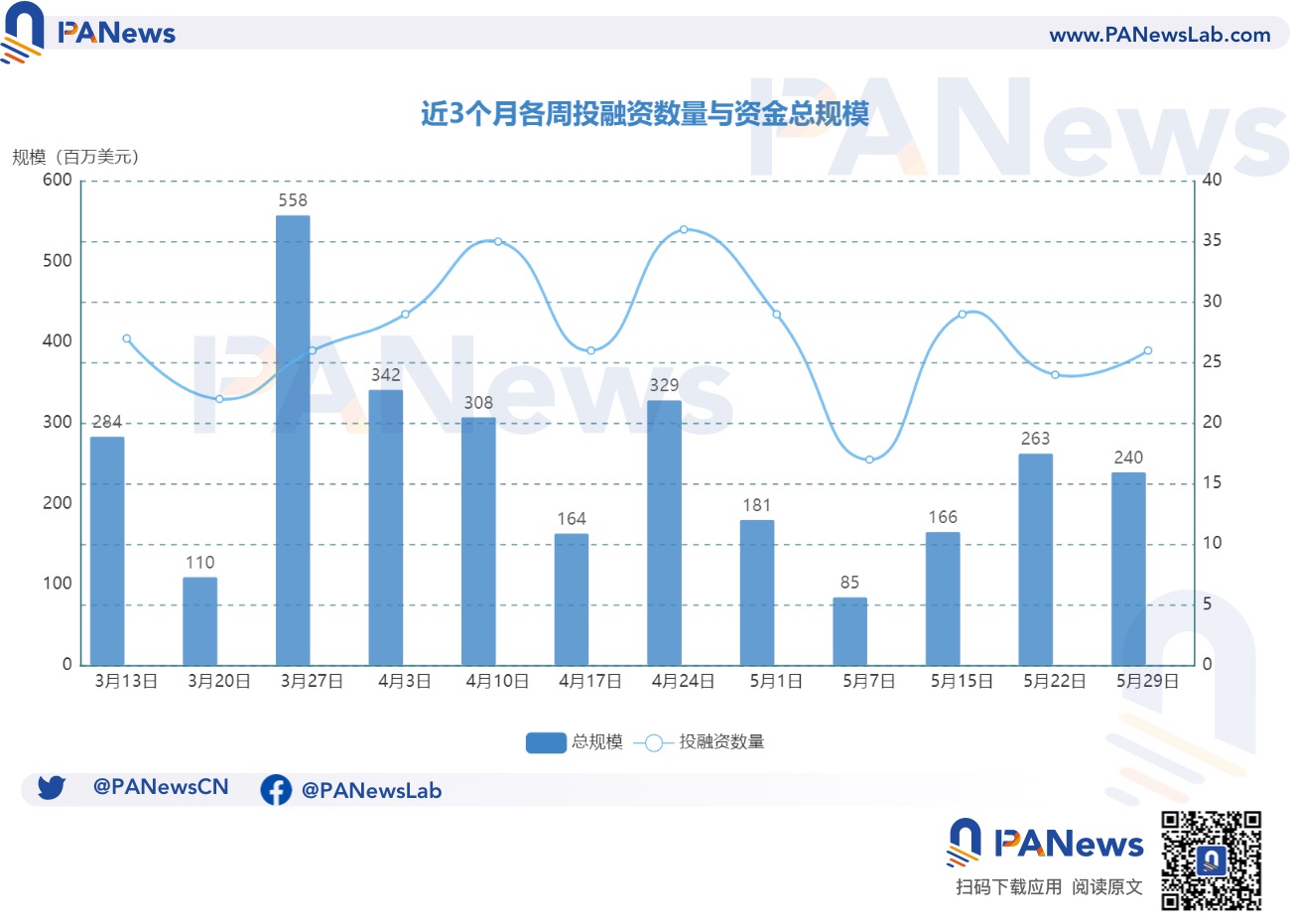

According to BlockingNews incomplete statistics, there were 26 blockchain financing events worldwide last week (5.22-5.28), with a total funding size of approximately $240 million, as follows:

- DeFi announced 4 financing events, including the liquidity collateral derivatives protocol DeFi protocol Num Finance announced the completion of a $1.5 million financing, and stablecoin developer Reserve participated;

- The chain game track announced 5 financing events, including Web3 game studio Pomerium receiving $20 million in angel investment;

- The NFT and Metaverse sector announced 1 financing event, with GoodGang Labs raising $2 million in seed funding, with participation from Kakao Investment;

- The infrastructure and tools track announced 7 financing events, including the team behind Worldcoin raising $115 million in Series C financing for Tools for Humanity, led by Blockchain Capital, with participation from a16z;

- The other Web3/crypto-related projects announced 7 financing events, including the blockchain energy trading platform UrbanChain announcing the completion of a £5.25 million Series A financing, led by Eurazeo;

- The centralized finance sector announced 2 financing events, including digital currency exchange Growminer announcing it has received $48 million in strategic financing.

Now let’s take a comprehensive look back at last week’s financing events.

DeFi

DeFi protocol Num Finance completed a $1.5 million financing, with participation from Ripio Venture

- How does DVT play an important role in decentralized Ethereum?

- Wu’s Weekly Picks: Hong Kong to Announce New Rules for Retail Trading, Core PCE Index Exceeds Expectations, Multichain Cross-Chain Abnormalities, and Top 10 News (May 20-26)

- Conflict of opinions, ideological differences? Analyzing the arrogance and prejudice in the Ethereum Black Mountain Conference

DeFi protocol Num Finance announced the completion of a $1.5 million financing, with participation from stablecoin developer Reserve, H2O Scouter Fund, Ripio Venture, VC3 DAO, and Auth0 Chief Technology Officer Matias Woloski. Num Finance will expand its stablecoin products next month and develop real-world asset (RWA) products.

Narwhal Finance, a perpetual contract trading platform, completed a strategic financing with a valuation of $25 million, with participation from Animoca Ventures.

Narwhal Finance, a decentralized dual-chain perpetual contract trading platform running on Arbitrum and BNB Chain, announced the completion of a strategic financing round with a valuation of $25 million. Participants include Animoca Ventures, Hailstone Ventures, and others. Narwhal Finance also announced a partnership with Pyth Network to build oracle services, as well as a partnership with Wormhole to build token bridging services.

RedStone Oracles, a DeFi oracle, completed an angel round financing with participation from Aave founder, among others.

DeFi oracle RedStone Oracles announced the completion of an angel round financing, with participation from Aave founder Stani Kulechov, Polygon co-founder Sandeep Nailwal, zkSync co-founder Alex Gluchovski, Avalanche co-founder Emin Gun Sirer, and others. Since its establishment in 2021, RedStone Oracles has raised $7.5 million in funding from institutions such as Lemniscap, Blockchain Capital, and Coinbase Ventures.

Kana Labs, a Web3 trading aggregation platform, completed a new round of financing with participation from MARBLEX.

Web3 trading aggregation platform Kana Labs announced the completion of a new round of financing, with participation from MARBLEX, a blockchain gaming ecosystem project built on the Klaytn mainnet by Netmarble, Korea’s largest mobile game developer. Kana Labs covers multiple blockchains (Polygon, Solana, Aptos, Neon) with cross-chain DeFi services, supporting cross-chain transactions, cross-chain lending, yield aggregation, and other functions, providing Web3 middleware SDK toolkits and smart wallet solutions on the B2B side, and offering Swap, pledging, and yield generation services on the B2C side.

Blockchain Gaming

Web3 gaming studio Pomerium receives $20 million in angel investment.

Web3 gaming studio Pomerium announced that it has received $20 million in angel investment from an undisclosed investor. The funding will enable the company to expand its portfolio of blockchain-based games and drive Web3 gaming innovation. Pomerium was founded in February 2022 and is a Web3 multi-game platform focused on mobile games. The platform’s token economy aims to create a sustainable mobile game ecosystem. Pomerium plans to expand its services in the GameFi market in the coming years.

BurgerCities, a metaverse game, completes a $4 million strategic financing round, led by Vega Ventures.

Blockchain-based metaverse game BurgerCities, valued at $50 million, has completed a $4 million strategic round of financing led by Vega Ventures, with SAYUAN Labs and Bitfly Capital participating. The one-stop game and P2E MetaFi platform BurgerCities aims to create a unified and standardized Web3 metaverse world by integrating DeFi and NFTs, where users can engage in social and gaming activities and experience DeFi and NFT features such as trading, staking, NFT exhibitions, and Gamefi using their avatars.

Web3 game startup Arena of Faith completes $1.75M seed round led by Chain Hill Capital

Web3 MOBA-style competitive game Arena of Faith has completed a $1.75 million seed round led by Chain Hill Capital. Arena of Faith focuses on serving the MOBA esports ecosystem and building a decentralized event system, committed to better adapting to the user needs of the current MOBA market through Web3 business models. The core team of Arena of Faith consists of Tencent Interactive Entertainment esports game production managers, former Ubisoft senior experts, Tencent Tianmei studio senior developers, and Cosmos ecological technology core contributors.

Web3 game publisher BoomLand completes $1M pre-seed round with participation from Polygon

Web3 game publisher BoomLand has completed a $1 million pre-seed round with participation from Polygon, Game7, MagicEden, Hyperithm, and some private investors. BoomLand has previously completed soft launches and first NFT sales, and its first blockchain game Hunters On-Chain is scheduled to be released later this month.

Web3 game studio Metagame Industries completes strategic financing at an estimated valuation of nearly $100M, with participation from Mysten Labs

Web3 game studio Metagame Industries announced the completion of a strategic round of financing with an estimated valuation of nearly $100 million. Sui public chain developer Mysten Labs, game developer Funplus/Xterio Ecosystem Fund, 2Moon Capital, and others participated.

According to reports, Abyss World, the first action role-playing game in the Sui ecosystem developed by the studio, has received 120,000 pre-orders on the global Steam wish list. The project has opened whitelist invitations and will conduct ID0 in the near future. According to the roadmap, Abyss World will officially launch its public beta in the third quarter of this year.

NFT&Metaverse

GoodGang Labs raises $2 million in seed funding, with participation from Kakao Investment

Singaporean communications firm GoodGang Labs, which focuses on virtual avatars, has announced the completion of a $2m seed funding round with participation from Kakao Investment. The funds will be used to build the 3D kiki town environment. GoodGang Labs will also launch GangHouse for Web3, which will allow users to communicate in real time using NFTs as a medium.

Infrastructure & Tools

Worldcoin raises $115 million in Series C funding, led by Blockchain Capital

Tools for Humanity, the team behind Worldcoin, has raised $115m in Series C funding, with Blockchain Capital leading the round and a16z, Bain Capital Crypto, and Distributed Global also participating. Tools for Humanity co-founder and CEO Alex Blania declined to provide a valuation in an interview.

Web3 development platform Sort raises $3.5 million in seed funding, co-led by Lemniscap and The General Blockingrtnership

Web3 application development platform Sort has raised $3.5m in seed funding co-led by venture capital firms Lemniscap and The General Blockingrtnership. Alliance DAO, Punk DAO, Orange DAO, the Defiant, Snowfro, Red Rooster Ventures and some angel investors from Coinbase, Gemini, and Snyk also participated. The funds will be used to expand the Sort team, advance the platform’s product suite, and accelerate the launch of Sort Apps, a full-stack for UI development for blockchain contracts.

Crypto infrastructure start-up Openfort raises $3 million in funding

Openfort, a crypto infrastructure start-up, has raised $3m in seed funding to develop its “wallet-as-a-service” software product for game developers and publishers. The round was co-led by Gumi Cryptos Capital and Maven 11. Game7, NGC Ventures, and Newman Capital also participated. Openfort’s wallet will support the Ethereum Virtual Machine (EVM). Openfort focuses on enabling developers to abstract functionality such as pre-approved transactions and bundled accounts.

Smart contract platform Firechain raises $3 million in Pre-Seed funding

Smart contract platform Firechain has announced it raised $3m in Pre-Seed funding with Genblock Capital leading the round and participation from MGNR, Cogitent Ventures, 1NVST, and Ankr. Firechain said it plans to launch a public testnet for its DLT network in June. Firechain has built an asynchronous, event-driven hybrid ledger model architecture to support features such as feeless transactions and provably secure on-chain randomness.

Tanssi developer Moondance Labs completes $3 million seed round, led by Arrington Capital

Moondance Labs, the developer of the Tanssi application chain infrastructure protocol, has announced the completion of a $3 million seed round of financing led by Arrington Capital, with participation from Borderless Capital, HashKey Capital, D1 Ventures, Hypersphere, C² Ventures, and Jsquare. Tanssi Network is an application chain infrastructure protocol that provides permissionless infrastructure tools and services. Additionally, the Tanssi protocol benefits from the additional advantages of shared security and native interoperability in the Polkadot relay chain. The Tanssi test network is expected to launch later this year, with the mainnet going live in 2024.

MEV infrastructure FastLane Labs completes $2.3 million financing, led by Multicoin Capital

MEV infrastructure FastLane Labs has completed a $2.3 million seed round of financing, with investment from cryptocurrency-focused investment firm Multicoin Capital as lead investor, as well as Polygon Ventures, Shima Capital, Delphi Ventures, and others. The fundraising marks Multicoin’s third support of MEV infrastructure. FastLane Labs was founded in March 2022 and provides an auction system that gives validators the chance to receive rewards without spamming the blockchain. FastLane Labs is the largest Maximum Extractable Value (MEV0) protocol on Polygon.

Bitcoin domain project BTCDomain completes angel round of financing

Bitcoin ecological domain name project BTCDomain has announced the completion of an angel round of financing, with investors including Element and LK Venture founder WangFeng, Bitrise Capital founder Kevin Shao, and investment firm Waterdrip Capital.

After this round of financing, BTCDomain will further develop the application scenarios of Bitcoin domain names, promoting the broader development of the Bitcoin ecosystem in areas such as ZK resolution, wallet payments, on-chain websites, and decentralized social networks.

Other

Blockchain energy trading platform UrbanChain completes £5.25 million Series A financing, led by Eurazeo

Blockchain energy trading platform UrbanChain has announced the completion of a £5.25 million Series A financing round, led by Eurazeo and becoming one of the company’s major shareholders. UrbanChain currently operates a P2P energy trading platform in the UK, which matches renewable energy generators and consumers using blockchain and AI systems to provide users with reasonable electricity price services, thereby reducing corporate and household electricity bills.

Web3 creator community app PoPP completes $4 million angel round of financing

Web3 creator community app PoPP announced the completion of a $4 million angel round of financing, led by Foresight Ventures, with several other institutions and individuals participating. After this round of financing, PoPP’s valuation reached $40 million. It is reported that PoPP uses blockchain technology to build users’ personal meta-universe social relationships, supports users to issue programmable soul-binding tokens and NFTs, in order to carry their social relationships, organizational relationships, equity vouchers, and works, allowing community contributors to gain revenue and helping users discover more valuable content on the platform. Its product is about to launch on the App Store and begin public testing.

Syntropy, a distributed routing protocol, completes $4 million in financing

Distributed routing protocol Syntropy announced the completion of $4 million in financing, with investors including Alpha Transform Group, Alphemy Capital, Denali Digital, etc. Syntropy launched a new Web3 product during Aptos Hack Holland. Syntropy is transforming the public Internet into a secure and user-centric Internet through a unified layer that incorporates encryption and optimization performance, and automatically enables anything connected to it.

LabDAO, a decentralized autonomous organization focused on open-source drug discovery, completes $3.6 million in financing

LabDAO, a decentralized autonomous organization focused on open-source drug discovery, has completed $3.6 million in financing, led by Inflection.xyz and Village Global, with participation from North Island Ventures and former Coinbase CTO Balaji Srinivasan, among others. The fundraising announcement comes as the PLEX software platform is launched. PLEX is a client that enables scientists and labs to communicate and interact. In addition, Openlab is a non-profit organization established by the LabDAO team in Switzerland.

Web3 artificial intelligence engine Orbofi AI completes $2.8 million in financing

Web3 artificial intelligence engine Orbofi AI announced that it has raised $2.8 million through token sales. The private placement round was led by a consortium of well-known venture capital companies, including Cogitent Ventures, OIG Capital, CSP DAO, Zephyrus Capital, and Halvings Capital. Orbofi AI plans to release its application in the third quarter of 2023.

Loot Labs completes $1.5 million seed round of financing, led by BITKRAFT Ventures

Web3 loot box development company Loot Labs has completed a $1.5 million Pre-Seed round of financing, led by BITKRAFT Ventures, with participation from Polygon Ventures, Mechanism Capital, Lofty Ventures Syndicate, and video game anchor Hammoudi Yassuo Abdalrhman. The new funds will be used for the development of the Web3 loot box platform Boxed.gg, marketing work, and establishment of partnerships to strengthen community participation in existing assets.

Blockchain startup Nutrios raises $500,000 in funding, with participation from Aptos Labs and Monoceros

Blockchain startup Nutrios has announced that it has raised $500,000 in funding, with participation from Aptos Labs, Monoceros and others. Nutrios developed the Dinder APP, a blockchain-based food pairing application launched by celebrity chef James Briscione. Users can swipe right or left on food photos, and the Dinder APP’s AI algorithm will learn their preferences over time and provide ordering services. Foods that are “liked” will be embedded into the blockchain social graph. The app is currently undergoing beta testing in the Miami market.

Centralized Finance

Growminer, a cryptocurrency exchange, has secured $48 million in strategic financing

Cryptocurrency exchange Growminer has announced that it has secured $48 million in strategic financing. The specific investors have not been disclosed. It is said that some global funds, investment groups, and professional investment institutions participated in the financing. Growminer mainly provides trading tools for institutional and individual investors, and is currently in the regulatory approval process, expected to launch next month.

Onyx Private, a digital bank, raises $4.1 million, with participation from Y Combinator and others

Digital bank Onyx Private has announced that it has raised $4.1 million in funding, with participation from Village Global, Y Combinator, Global Founders Capital, One Way Ventures, 186 Ventures and Olive Tree Capital. Onyx Private is currently working with Piermont Bank to provide digital banking services. In terms of investment, it provides users with high-yield, fixed-income investment portfolio products. Its investment services are managed by Helium Advisors, and the brokerage account is cleared through Pershing, a clearinghouse owned by New York Mellon Bank.

Institutional Fund

Moonfire Ventures raises $115 million for its second fund to invest in AI, Web3, and other areas

Venture capital firm Moonfire Ventures announced that its Fund II has raised $115 million to support early-stage European startups. Moonfire Ventures’ AI-driven approach allows it to review a large number of companies each week and find the most promising founders in Europe. By leveraging next-generation technologies such as AI, Web3, and AR/VR, Moonfire Ventures aims to transform key industries, including health, work, finance, and gaming. Web3 projects previously invested in by Moonfire Ventures include NFT football game developer Goals and Web3 marketing platform Sesame Labs.

QED’s two fintech investment funds under QED have raised $925 million

QED Investors, a venture capital firm based in Alexandria, Virginia, announced that its two funds have raised a total of $925 million, with one early-stage fund raising $650 million and the other early growth fund raising $275 million. The new funds will support QED’s continued investment in payments, lending, and cryptocurrency globally.

QED Investors was founded in 2007 by Nigel Morris and Frank Rotman and has invested in over 200 companies, with 28 of them receiving funding valuations of over $1 billion. QED has supported fintech companies such as Credit Karma, Klarna, Nubank, and Remitly, and its cryptocurrency investment portfolio includes crypto finance company Meow, blockchain development platform QuickNode, and fintech payment company Tribal Credit, among others.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!