The battle for the No. 1 in the crypto world ended. Zhao changpeng, “The richest man in China” defeated SBF in one fell swoop. The overnight FTX sought the acquisition of currency security, causing a great uproar in the currency circle, just like another Luna currency crisis.

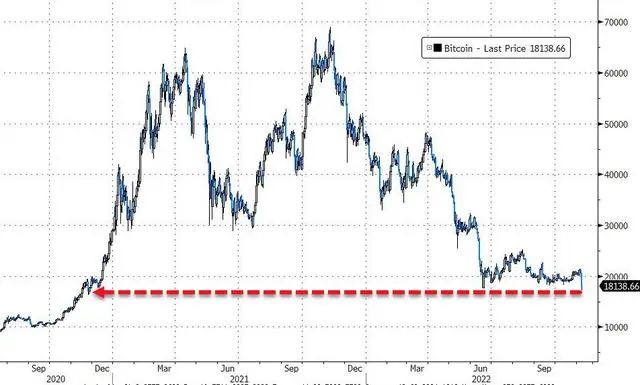

Bitcoin plunged 20% , the FTX’s FTT dropped back to its 2021 level in January, evaporating 90% from its peak, and there were reports that SBF was almost wiped out.

For the entire monetary circle, even the“Saviour” such as the FTX can“Collapse overnight”, an instant into the face of trust and asset loss crisis of the company, then the stability of the entire industry can be said to be fragile.

More importantly, this time for the FTX backstop is money security, but look at the whole money circle, there is also the ability of the”White Knight” has been less and less.

- Will the FTX incident be the “last straw that broke the camel’s back”?

- The epic reversal of the plot, CZ announced that it will completely acquire FTX

- Crypto Lehman Moment: A Full Review of the Last 48 Hours

Currency Circle Thunder, FTX seeking currency security acquisition

As of November 8, the onlookers were still reeling from the Twitter war between”Money Circle Musk” Sam Bankman-Fried (SBF) and”China’s richest man” Zhao Changpeng (CZ) , fTX suffered a $6 billion run in three days, currency Ann became deep“Death spiral” FTX the last“Straw.

The“Tough-talking” SBF failed to prevent the FTX from falling into a liquidity crisis and had to seek help from Zhao Changpeng’s Qian’an. Zhao later confirmed on Twitter that Qian’an was interested in buying the FTX, although he did not disclose specific terms, but SBF’s $15.6 bn fortune is likely to be wiped out by its rivals.

Before Tuesday’s acquisition, SBF held a 53 per cent stake in FTX worth about $6.2 bn, while its holdings in Alameda Research contributed about $7.4 bn to his personal wealth, according to data. SBF’s total assets are about $15.6 bn.

According to Bloomberg’s hypothesis, all FTX investors would disappear as soon as SBF sought a deal with the company, and the valuations of FTX and Alameda would drop to $1 in an instant, meaning that, sBF’s total assets are now about $1bn, and Tuesday has lost 94 per cent of that in a single day.

In January, three funds, including the Softbank Vision Fund, invested $400m, valuing the FTX at $32bn, this has certainly raised broader concerns among investors about cryptocurrency markets: if the SBF is not secure, then who is?

Before the news of the deal, FTT had fallen to $17.97 on Tuesday, down more than 30% in 24 hours from $25.90 previously. The FTT, still the world’s worst-performing cryptocurrency according to CoinMarketCap, pared its recent 24-hour decline to around 24% in midday trading after the deal was announced. Tuesday’s shares were also among the worst-performing cryptocurrencies in the world, according to CoinMarketCap, bNB, the tokens of Chien an, has risen more than 12% in the last 24 hours.

The cryptocurrency’s decline widened, with bitcoin, the most valuable currency, falling below $17,000 in late trading on Wall Street, hitting a nearly two-year low since November 2020 and down nearly 20 per cent from its intraday high.

SBF played down the dispute, saying the acquisition would benefit the cryptocurrency industry as a whole

The dispute was highlighted on Tuesday when the SBF announced its deal with MNA, saying:

I know there have been rumors in the media that our two exchanges are in conflict, however, MNA has repeatedly stated that they are committed to a more decentralized global economy, and working to improve the relationship between the industry and regulators. We are in the hands of competent people.

In a tweet, SBF also expressed deep gratitude to Qian an, Zhao Changpeng, its chief executive, and all supporters of the FTX, saying:

The agreement with MNA is”A user-centric development that benefits the industry as a whole.”. “Zhao has done extraordinary work to build a global encrypted ecosystem and a freer economic world and will continue to do so.”

The”War” between money security and FTX

Although the SBF tried to play down the dispute with the currency security, but before their heated war has caused the currency circle”Earthquake.”.

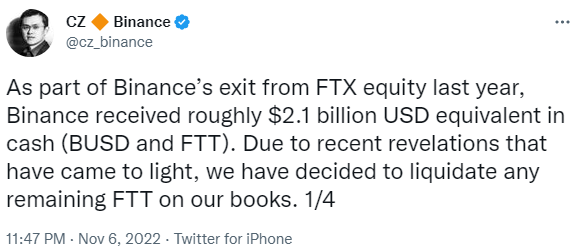

Wall Street News just as Tuesday had mentioned earlier that on November 3rd the disclosure by CoinDesk, a cryptocurrency website, earlier this month sparked fears that Alameda Research, a hedge fund founded by SBF, would go bankrupt, the FTX will be in a liquidity crisis. The FTX has come to a head after MNA said it would liquidate more than 23m FTX-issued tokens, the FTT.

According to Coindesk, FTT is the single largest asset on Alameda’s balance sheet, with Alameda holding about 140m FTT units, or 70 per cent of the 200m FTT units in circulation, and $5.8 bn in FTT-related assets, it accounts for 88 per cent of its net worth.

On November 5, Ho Yi, a co-founder of MCA, lampooned the FTX operation, saying:

Money security does not give unsecured loans, do not participate in the transaction, do not buy companies, do not spend money to sponsor, 20% of the FTX shares have been sold, head, head down to do things.

On November 6th Caroline Ellison, co-CEO of Alameda Research, finally tweeted back that Coindesk’s disclosed balance sheet was only a fraction of the company’s assets, with more than $10bn of assets unaccounted for, she said most of the loans had been repaid:

Given the tightening of crypto-credit space this year, we have now repaid most of our loans, and we clearly have some that were not disclosed by Coindesk.

SBF high-profile clarifies that all operations are normal. Zhao changpeng immediately posted that the fear Luna”Death Vortex” repeat, will sell all the FTT on the books.

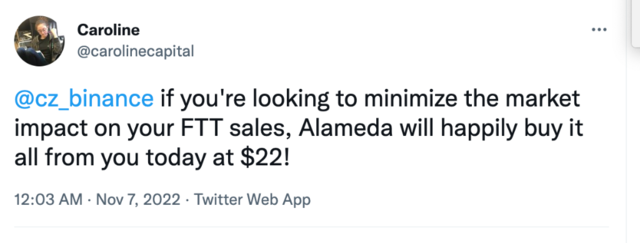

Alameda immediately offered to pay $22 a unit for all the FTT MCA was selling.

But many doubt the FTX will be able to come up with a $580m buy-back.

Now, overnight, the rescuers are trapped.

Fragile ecosystems

Although the near-disaster was temporarily resolved, one of the key conclusions of the Whirlwind Week for investors was that the cryptocurrency ecosystem remained fragile and vulnerable to runs.

Some industry critics say the FTX could fall apart in a matter of days, a sign of how vulnerable the industry is to customer churn and of the dwindling pool of potential saviors. John Reed Stark, a former executive attorney with the Securities and Exchange Commission, said:

The death spiral for cryptocurrencies can start in an instant and seems imminent.

Analysts believe the FTX’s rapid collapse would have caught regulators’ attention. Owen Tedford, analyst at Beacon Policy Advisors, says regulators may require firewalls between businesses such as FTX and Alameda:

Lawmakers and regulators will see this as evidence of their belief in the need for greater transparency and more investor protection.

Some equity analysts said FTX’s weakness could provide short-term benefits to trading platforms such as Coinbase, but FTX’s troubles have raised concerns about the industry’s overall vulnerability, this vulnerability may do more harm than good.

John Todaro, analyst at Needham, said that while the FTX’s problems had brought new clients to Coinbase, retail investors”Might consider moving assets into private wallets as centralised trading problems persist”.

In the summer SBF played the role of “The mother of all currency circles,” many pointed to 1907, when Punter Morgan, the founder of Morgan John Peale Bishop, was so powerful and influential, leading a group of bankers to buy or lend to failing companies rescued the US from the crisis. At the time, Morgan was effectively acting as a”Central bank”.

Although Morgan was a hero in 1907, the long-term impact of that banking crisis was the creation of the Federal Reserve to ward off panic.

But until us regulation of cryptocurrencies is likely to be introduced next year, it may be hard to count on anyone playing the role again.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!