Note: The original text is from Medium, authored by Four pillars, compiled and edited by the White Sesame Research Institute. Due to length reasons, some deletions and amendments have been made.

In January 2023, Casey Rodarmor, a core contributor to Bitcoin, proposed “Ordinals Theory” and created the Ordinals protocol, which caused a frenzy on the Bitcoin network, evoking memories of the NFT minting frenzy that occurred on Ethereum. “Ordinals Theory” allows users to write any type of file (images, text, videos, etc.) onto satoshis, the smallest unit of Bitcoin, as long as the file size does not exceed 4 MB, thus storing various files on the chain.

Shortly thereafter, Domo developed a new token standard called BRC-20 based on the Ordinals protocol. Essentially, BRC-20 is a new method of facilitating token issuance and transfer by writing text on satoshis. This standard gained a lot of attention in April, and the number of BRC-20 tokens surged, leading to a sharp increase in Bitcoin on-chain transaction fees on May 8th. At the time, the Bitcoin network faced over 400,000 unprocessed transactions, causing the cryptocurrency trading platform Binance to stop accepting Bitcoin deposits and withdrawals.

- Coindesk: Has the industry become better one year after Terra-Luna went to zero?

- Highlights of the Ethereum Summit: Latest Trends and High-Quality Projects

- Which projects were ultimately selected for the Ethereum conference EDCON 2023 Super Demo?

As BRC-20 tokens gained attention, their prices also saw significant increases. The price of the first token in the BRC-20 standard, ordi, started at $0.1 and eventually rose 310 times to $31 on May 8th, with a market capitalization of nearly $650 million. This level of market capitalization ranked it around 70th on Coingecko, even surpassing Sui and Optimism.

However, this trend was short-lived and is now showing signs of weakening. Nevertheless, it must be acknowledged that the emergence of the BRC-20 standard has brought significant attention back to Bitcoin after a long period of unfavorable market conditions.

Subsequently, more new token standards appeared and found their own niche – ORC-20 and SRC-20. From May 13th to 15th, trades involving ORC-20 tokens accounted for 10% of the total Bitcoin network transactions. In addition, SRC-20 tokens have recently begun to accumulate momentum.

Ordinals Theory

Ordinals Theory is not a new concept that emerged out of nowhere, but a derivative of a previous concept: ordinals, which are the sequence of numbers that indicate the order of satoshis, the smallest unit of Bitcoin. According to Ordinals Theory, each satoshi is numbered according to its mining order .

In fact, the order of satoshis can be represented in multiple ways, including:

-

Integer representation : 2099994106992659 – digits arranged in order of mining, with a maximum value of 2.1 trillion because the total supply of bitcoin is 21,000,000 and 1 BTC is equal to 100,000,000 satoshis.

-

Decimal representation : 3891094.16797 – the number before the decimal point represents the height of the bitcoin block in which the satoshi was mined, and the number after the decimal point represents the order of the satoshi within that block.

-

Degree representation : 3°111094′214″16797‴ – the last set of numbers represents the order in which the satoshi was mined in the block, and the numbers before that represent the block height in degrees.

-

Percentile notation : 99.99971949060254% – a way of representing the percentage of total bitcoin supply that a satoshi represents.

-

Naming : a method of sorting satoshis using letters from a-z.

Interestingly, the creator of the ordinal theory also assigned rarity to each satoshi based on the order it was assigned:

-

Common : all satoshis in a block except the first one.

-

Uncommon : the first satoshi in each block (which appears approximately every 10 minutes).

-

Rare : the first satoshi after a difficulty adjustment (which appears approximately every two weeks).

-

Epic : the first satoshi after a halving event (which occurs approximately every 4 years).

-

Legendary : the first satoshi at the intersection of a difficulty adjustment and a halving event (which occurs approximately every 24 years).

-

Mythic : the first satoshi in the bitcoin genesis block (of which there is only one).

Inscription: Writing Files Into Satoshis

The ordinal theory gives each satoshi a unique order, and the Segwit and Taproot upgrades to the bitcoin network make it possible to write files into satoshis.

SegWit is short for Segregated Witness, an upgrade applied to the Bitcoin Core client network in 2017. While SegWit solved the long-standing transaction scalability issue in the Bitcoin network and paved the way for the operation of the Lightning Network, the most important thing related to this upgrade is the expansion of block size.

SegWit introduced a new concept – block weight, which changes the unit of block size from Bytes to vBytes, where 1 vByte is equivalent to 4 weight units. Therefore, the maximum block size has been changed from 1 MB to 1 vMB. In addition, the existing transaction data is divided into two parts: a. transaction data, b. witness data. Transaction data contains information on the sender, receiver, input, and output, while witness data contains information on the script and signature data.

Subsequently, the Taproot upgrade pushed forward by updating the script language used in the Bitcoin network to Tapscript. After the upgrade, wider transactions became feasible on the Bitcoin network, and ordinal theory used it to record various files through witness data on satoshis.

Essentially, each satoshi has a unique serial number and can store data, similar to an NFT. However, unlike most NFTs in the Ethereum ecosystem, the inscription process records all data, making it a more authentic “blockchain-native” NFT than Ethereum NFTs. Users can use the Ordinals protocol to record files on satoshis, and the satoshis containing the files can be traded (exchanged) like normal bitcoins.

However, a significant challenge to achieve this is that users must use a wallet compatible with Ordinals. Although the inscription is recorded on satoshis, the challenge comes from the inability to distinguish these inscribed satoshis from other bitcoins. Therefore, there is a risk of accidentally using the satoshis containing the files as miner fees when transferring regular BTC. Therefore, Ordinals users should choose a wallet that is easy to control and select satoshis.

Example

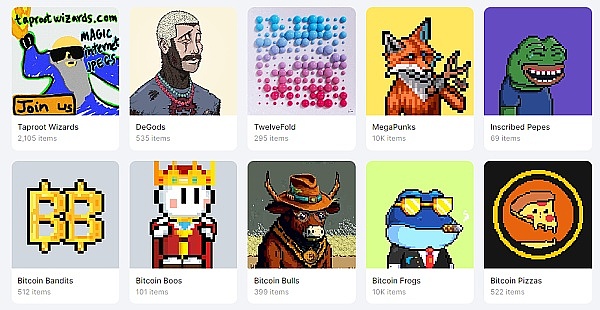

So far, early users have created various Bitcoin NFTs using the Ordinals protocol. The earliest ones were all images, and the first recorded inscription was the 727,624,168,684,699th satoshi with a dickbutt image.

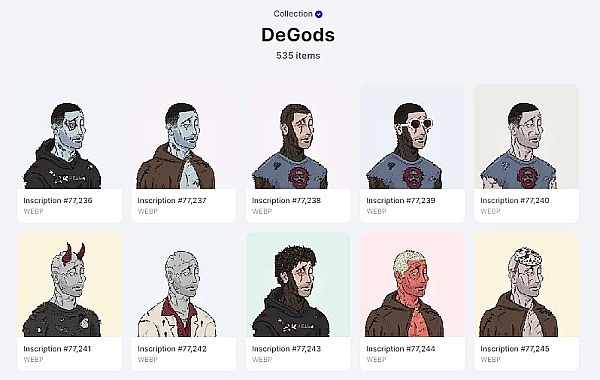

Dustlabs used the Ordinals protocol to package their 535 DeGods into a block (block #776408), while Yuga Labs, the developer of the well-known Ethereum NFT “Bored Ape,” put a set of generative art called TwelveFold on the Bitcoin network.

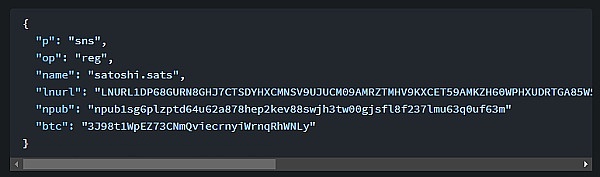

Meanwhile, many interesting experiments are using text. In addition to the BRC-20 we will focus on below, Sats Names is also a good example.

Ethereum Name Service (ENS) is a naming service on the Ethereum network, while Sats Names is a naming service on the Bitcoin network. To register a name, simply enter text in JSON syntax, as shown above.

Can this allow anyone to use unique names freely? For example, if Xiaoming creates the name “bitcoin.sats,” and Xiaohong creates the same name “bitcoin.sats” on a different sat, this may cause ambiguity. Sats Names mainly recognizes the ownership of a specific name – belonging to the sat that created the name first. Therefore, if the Bitcoin naming service wants to be widely used, the limitation is that a separate indexer is needed to distinguish name types and ownership.

BRC-20

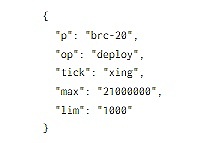

BRC-20 is an experimental token standard proposed by Domo in March 2023, which allows anyone to issue new tokens on the Bitcoin network by engraving text.

Unlike Ethereum’s ERC-20, where tokens can be issued and transferred immediately after deploying a smart contract, BRC-20 tokens are not actual tokens, but rather sats that record specific text. Therefore, like Sats Names, a separate indexer is needed to understand the status or balance of BRC-20 tokens.

Due to the different issuance methods of BRC-20 tokens from ERC-20 tokens, the deployment, minting, and transfer stages may be difficult to understand. For the convenience of readers to better understand, we take the existing BRC-20 token XING as an example.

Deployment:

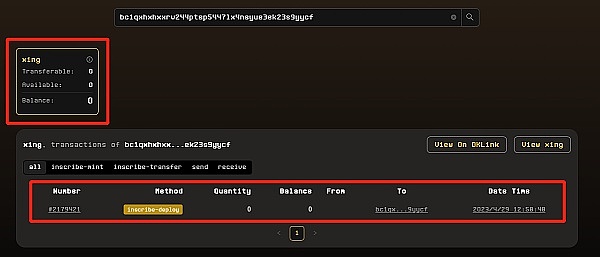

The deployment of the XING token was recorded by bc1qxhxhxxrv244ptsp5447lx4nsyue3ek23s9yycf (the deployer) in sat #1934771250000000. However, since this deployer only deployed the XING token and did not mint any, we can see that their XING token balance is zero.

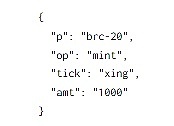

Minting:

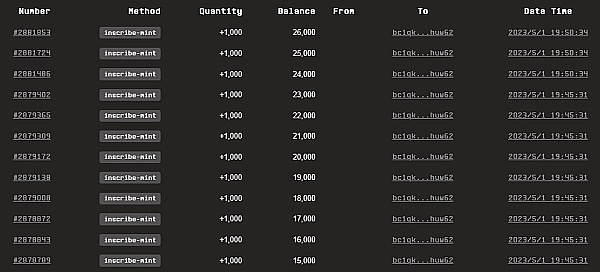

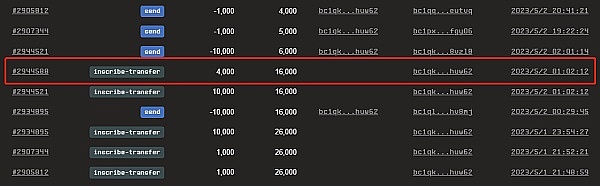

A minter bc1qk3fqhw8txe5ev0s8n7rj2e3z564uw02hfhuw62 inscribed the above text into 26 different satoshis, minting a total of 26,000 XING tokens, as shown below. The reason for minting 26,000 tokens across 26 satoshis instead of all at once is because the maximum minting amount set by the deployer is 1,000.

Transfer:

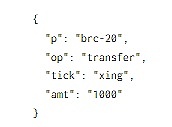

To transfer 26,000 XING tokens, bc1qk3fqhw8txe5ev0s8n7rj2e3z564uw02hfhuw62 inscribed the above text into 5 satoshis to transfer 22,000 XING tokens.

Balance:

So how many XING tokens does the wallet address in the above example ultimately hold?

-

bc1qxhxhxxrv244ptsp5447lx4nsyue3ek23s9yycf (deployer): Deployed only XING tokens and did not mint them, so the balance is 0.

-

bc1qk3fqhw8txe5ev0s8n7rj2e3z564uw02hfhuw62 (minter/sender): Searching for this address on Ordiscan shows that it holds 26 XING inscriptions. However, this address minted 26,000 tokens and sent 22,000 tokens, so why does it still have 26 inscriptions? This is because for BRC-20 tokens, transferring is not transferring existing mint inscriptions, but rather inscribing a transfer text of XING into another satoshi and then completing the transfer. In other words, when the transfer occurs, the sender’s balance is deducted, and the XING transfer inscription is added to the recipient’s balance. Therefore, even though bc1q…uw62 retains the mint inscriptions with 26,000 tokens, the confirmed balance is 4,000, because the XING transfer inscription with 22,000 tokens was inscribed to another address.

In summary, BRC-20 introduced a new way to handle fungible tokens (FT) on the Bitcoin network, and has gained significant attention with the recent rise of memecoins (such as PEPE) on the Ethereum network.

In the past two months, nearly 50% of the transaction fees generated on the Bitcoin network have been related to ordinals, especially BRC-20. As of May 9, 2023, there were 1,599 deployed BRC-20 tokens, with a total network fee of 628.7 BTC related to minting and 46.8 BTC related to transfers, indicating a significant amount of network usage due to BRC-20.

The first BRC-20 token, ordi, started at $0.1 and skyrocketed to a high of $31 as it was listed on various centralized exchanges. In addition, other tokens such as nals, meme, pepe, and piza have market caps ranging from $10 million to $40 million.

Without smart contracts, are all BRC-20 token trading markets centralized?

How do BRC-20 token trades work? It is widely known that the Ethereum network supports smart contracts, allowing for the establishment of decentralized market protocols through smart contracts, but we cannot establish similar smart contracts on the Bitcoin network.

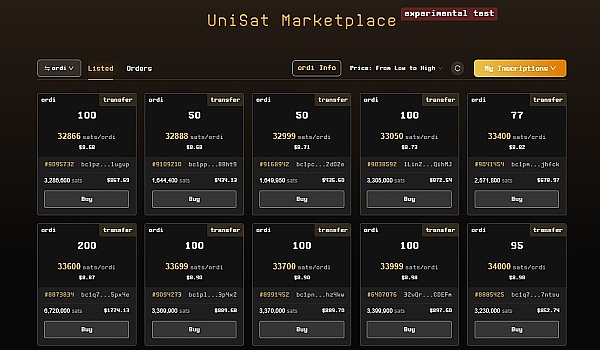

If you have used UniSat Marketplace, you will notice that various BRC-20 token trades are listed on the platform, and buyers can connect their Bitcoin wallets to make purchases. In addition to secondary market trades of BRC-20 tokens, this is also seen in various marketplaces for trading Bitcoin NFTs (such as MagicEden). Are all existing Ordinals markets using a centralized custodial approach?

The answer is PSBT (Partially Signed Bitcoin Transaction). PSBT is a feature introduced by BIP-174 that allows users to sign only some of the inputs. Therefore, UniSat and other Ordinals markets utilize PSBT to enable trading between buyers and sellers in a trustless and non-custodial manner.

The popularity of BRC-20 has led to a significant increase in Bitcoin network fees. However, this trend is short-lived and is now showing signs of weakening. This is where new token standards come into play – ORC-20 and SRC-20. From May 13th to 15th, trades involving ORC-20 tokens accounted for 10% of all trades. In addition, SRC-20 tokens have recently begun to gain momentum.

ORC-20

Although BRC-20 paved the way for using Ordinals to issue FTs on the Bitcoin network, it was a very early experiment and had many drawbacks:

First, when BRC-20 tokens were initially deployed, the total supply and the maximum token amount per mint were fixed and could not be changed. While this may be beneficial in some cases, it does limit the flexibility of the token model.

The second drawback is that the name of BRC-20 tokens can only have 4 characters. In contrast, ERC-20 tokens have names of different lengths. Removing the limit on the length of the token name would allow more projects to create tokens.

The third drawback is that the transfer of BRC-20 tokens depends entirely on external, centralized indexers. Because the inscription process simply writes data to a script, the Bitcoin network has no way to prevent inscriptions that violate the BRC-20 standard at the consensus level.

For example, if the maximum supply of BRC-20 ordi tokens is 21,000,000 and all 21,000,000 tokens have been minted, minting additional ordi tokens is invalid according to the BRC-20 token standard, but minting transactions will be recorded anyway because the transaction pays a fee. Therefore, it is entirely up to external indexers to determine which inscriptions are valid or invalid, and this situation has led to attackers exploiting weaknesses in the UniSat market to conduct double-spending attacks on BRC-20 tokens, resulting in economic losses.

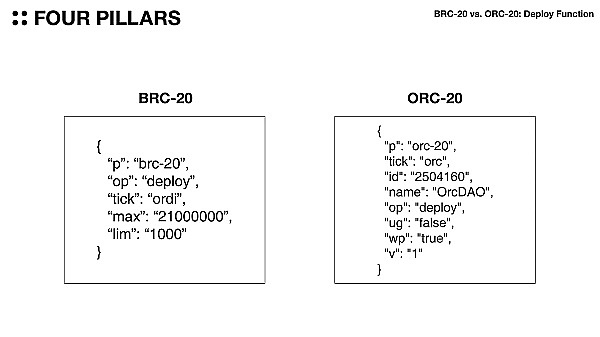

It can be said that ORC-20 is an upgraded version of the BRC-20 standard, which addresses some of the shortcomings of the BRC-20 standard:

1. Token Identification

ORC-20 standard brings substantial enhancement compared to the BRC-20 standard. One of the improvements is the addition of an identifier (ID) that can identify a specific token. In the BRC-20 standard, if tokens with the same name are deployed, the external indexer will regard the first deployed token as “legitimate”. In contrast, even tokens with the same name can still be distinguished in the ORC-20 standard because the “ID” is included in the inscription number at the time of deployment, allowing for identification.

2. Tokens with Arbitrary Length Names

Secondly, unlike BRC-20 standard which only allows for four-letter names, ORC-20 allows for names of any length. For example, the first ORC-20 token deployed, ORC, has a name that consists of three letters.

3. Upgradability

Thirdly, the ORC-20 standard introduces the ability to modify the total supply and the maximum token amount per mint. While this flexibility may be exploited by deployers, it also provides opportunities for various token economic experiments. These experiments may include gradually reducing the maximum token amount per mint, simulating Bitcoin halving, etc.

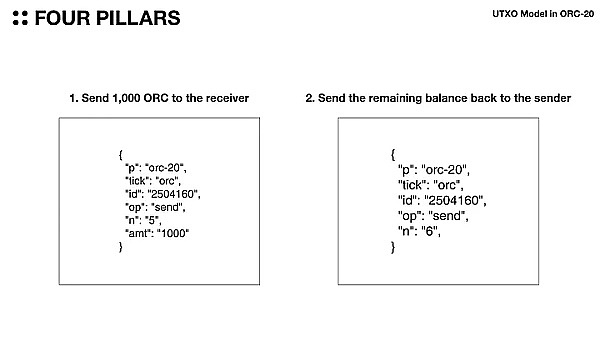

4. UTXO model

Fourthly, and most importantly, ORC-20 introduces the concept of UTXO for token transfer. For example, if A sends 2 dollars to B, and B already has 1 dollar, in the account model, B’s balance will show as 3 dollars – the 1 dollar and the 2 dollars combined. But in the UTXO model, B’s balance will have two separate UTXOs, one for 1 dollar, and one for 2 dollars. If B sends 2.5 dollars to C, then the 1 dollar and 2 dollars UTXOs are combined and split into 2.5 dollars and 0.5 dollars UTXOs, where 2.5 dollars go to C and 0.5 dollars stay with B. The advantage of this improved approach is that UTXOs can only be used once, essentially preventing double spending. ORC-20 introduces the concept of UTXO in token transfer, which is the biggest difference from BRC-20.

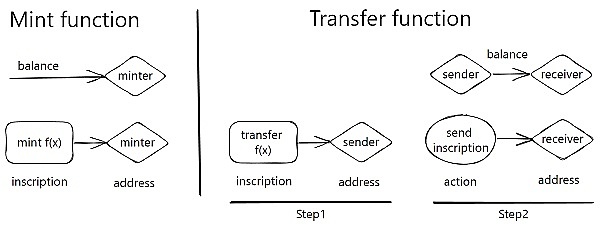

In order to send ORC-20 tokens, the sender must write the step 1 text in the above image into the smart contract, and the receiver needs to write the step 2 text so that the balance can be sent back to the sender. This is the same process as UTXO. Therefore, for wallets or markets adopting ORC-20, they must wait until the ORC-20 transfer transaction is completed.

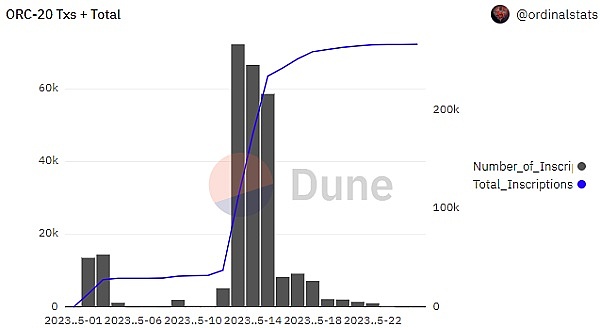

ORC-20 ecosystem and current status

Although ORC-20 has not been around as long as BRC-20, we can see that it is gaining some attraction, with a total transaction volume involving ORC-20 of around 260,000 transactions, costing around 19.5 BTC.

There are some community projects worth paying attention to, such as BitPunks which provides an ORC-20 browser and OrcDAO which uses the ORC token.

SRC-20

While the ORC-20 standard can be considered an enhanced version that corrects the limitations of BRC-20, the SRC-20 standard uses Stamps to inscribe text, which is completely different from the previous two standards.

BRC-20 and ORC-20 are based on ordinal theory, which involves writing arbitrary files in the witness data of Bitcoin transactions. However, this process occupies most of the capacity of the distributed ledger, allowing nodes to prune or eliminate witness data. In addition, not all nodes need to retain or propagate this witness data.

However, with Stamps, since information is stored in UTXOs, every full node must store them, making them more persistent than ordinals, or twice as “blockchain native.” Although this is an obvious advantage, the storage space for the data is limited, accepting only 24×24 pixel images or PNGs and GIFs with 8-bit depth.

The text used to deploy, mint, and transfer SRC-20 tokens is also in JSON format, which is very similar to BRC-20.

Summary

From Sats Names to the recently popular BRC-20, to ORC-20 and SRC-20, some people even try to incorporate staking functionality into BRC-20 tokens. Why are there so many experiments on the Bitcoin network?

First, compared with the strong security of the Bitcoin network, the utilization rate is still very low. The nature of the scripting language limits the execution of complex smart contracts on the Bitcoin network, thereby limiting its application. However, its excellent security level encourages developers and users to constantly test and utilize its functions. Of course, just storing and transferring funds has such a high level of security, so it would be great if this security could be used for various other use cases.

Second, text has unlimited expressive potential. Just like in the early days of PCs, many games were text-based, and text can inspire imagination and represent broad concepts. Sats Names, BRC-20, ORC-20, and SRC-20 tokens only use text to symbolize intangible entities and use external indexers to provide them with a tangible feel. Although these standards are still in their early stages and have their own limitations, there is no doubt that they will be the foundation for a large number of future innovative experiments.

Another question is how far these “X”RC-20 tokens can go. The Bitcoin network is fundamentally incapable of implementing complex smart contracts, and since BRC-20 tokens are not tangible like ERC-20 tokens, but are represented only by inscriptions recorded in Satoshi, it is difficult to imagine their utility beyond being traded as meme tokens. Perhaps we can imagine simple governance activities, where users connect their Bitcoin wallets and vote based on the number of BRC-20 tokens they hold, but executing governance results on-chain is still impractical.

Risk Warning:

According to the “Notice on Further Preventing and Resolving the Risks of Virtual Currency Trading Speculation” issued by the central bank and other departments, the content of this article is for information sharing only and does not promote or endorse any business and investment activities. Readers are strictly required to comply with local laws and regulations and not to participate in any illegal financial activities.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!