Since the emergence of blockchain technology in 2008, the cryptocurrency market has experienced rapid development. However, the total market value of the entire cryptocurrency market is still not as high as that of Apple, and Web3 still lacks practical applications in the real world. However, a new research report from Citibank titled “Money, Tokens, and Games” may change this situation. In the report, Citibank identifies real-world asset tokenization (RWA) as the next major narrative phase, which could have a significant impact on the development of Web3. It may bring the blockchain and Web3 industries the next billion users and potentially trillions of dollars in economic activity.

In this major narrative of real-world asset tokenization (RWA), the author of this article, a researcher of everything named Bocai, believes that the ERC-3525 standard has tremendous potential. This is a semi-homogeneous token (SFT) standard that combines the characteristics of ERC-20, ERC-721, and ERC-1155, making it more effective in representing and managing more complex assets such as bonds, coupons, invoices, futures, options, and ABS. In this way, ERC-3525 has great potential to promote the development of real-world asset tokenization (RWA), thereby promoting the widespread application of Web3 in the real world.

This article will compare the components of ERC-20, ERC-721, ERC-1155, and ERC-3525 to help you understand the differences between these token standards. Then, it explores the digital world modeling ideas of ERC-3525 from three levels, and finally looks forward to which areas ERC-3525 is worth paying attention to in the future.

Author: Bocai Bocai!

Special thanks to Samo for his careful polishing and optimization of this article.

- Table of Contents

- Background Introduction

- Comparison of Existing ERC Token Standards-How to Understand ERC-3525?

- ERC-20

- ERC-721

- ERC-1155

- ERC-3525

- Understanding ERC-3525 as a Digital World Modeling Idea from Three Levels

- Super NFTs that can be split and combined

- Generic digital container

- Visual smart contract

- What are the potential applications of ERC-3525 in the future?

- Real-world assets on the blockchain (RWA)

- Virtual assets or commodities

- Social, identity, and tokenized account domains

- Summary

Background

Before introducing ERC-3525, let’s first introduce what EIP and ERC are:

EIP, short for Ethereum Improvement Proposals, is a framework in the Ethereum community that allows anyone to propose improvements or updates to the Ethereum network. These proposals can involve the Ethereum protocol itself, related client APIs, or provide standards for other projects in the Ethereum ecosystem.

ERC, short for Ethereum Request For Comment, is a special type of EIP that focuses on application-level standards, such as smart contract design patterns and interface definitions. These ERCs typically provide a standard template for Ethereum application developers to ensure that different projects and applications can have a shared interface or standard. In short, all ERCs are EIPs, but not all EIPs are ERCs. EIPs cover a wider range, including changes to the underlying protocol.

ERC-3525 was created on December 1, 2020, by the core members of Solv Protocol and has been supported by core Ethereum developers. The process of its proposal and acceptance by the community took up to 20 months, and several drafts were improved during the period. Finally, it was formally adopted as an ERC token standard in September 2022. As an Ethereum standard created by a team of Chinese people, ERC-3525 has attracted new attention in the industry.

Comparison with existing ERC token standards – How to understand ERC-3525?

ERC-3525 is a semi-fungible token (SFT) standard. Many people may think that ERC-3525 is a monster stitched together from ERC-20 and ERC-721 at first glance, but in fact, ERC-3525 is a cornerstone generic standard and even has overwhelming advantages in some fields compared to ERC-20, ERC-721, and ERC-1155. Next, we will compare the key components of other token standards (ignoring other attributes such as name and symbol) and discuss the advantages and disadvantages of ERC-3525.

Image source: solv.finance PPT

ERC-20

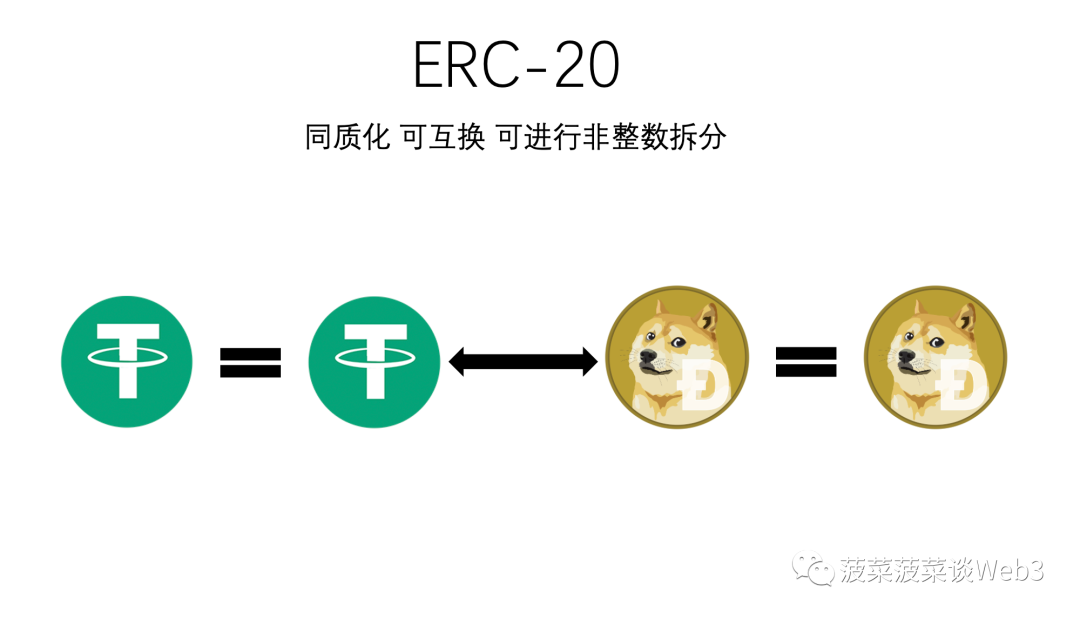

ERC-20 is one of the most widely used token standards in Ethereum applications, which refers to homogeneous tokens, meaning that each token is equivalent in function and value, with no differences. This is why they are called “homogeneous”. Stablecoins are an important example of ERC-20 applications, where each stablecoin is homogeneous and can be exchanged with each other, representing the same value.

Key components: address and value. Address refers to the address of the asset owner, and value represents the number of tokens that the address owns. Under the ERC-20 standard, each address can be associated with a balance (Value), which represents the number of tokens held by that address, and all balances are the same with no differences.

Features and advantages: ERC-20 tokens correspond to interchangeable assets, just like traditional currencies or shares, which makes ERC-20 very useful in many applications, such as representing shares of a company or serving as trading pairs for decentralized exchanges (DEXs). ERC-20 is also widely used in DeFi applications, such as lending platforms and liquidity mining, and ERC-20 can be split into non-integer amounts, so you can own 0.5 ERC-20 tokens.

Limitations: As ERC-20 tokens are completely interchangeable, they cannot be used to represent unique or non-fungible assets, such as artworks or collectibles.

ERC-721

Speaking of ERC-721, it is necessary to mention non-fungible tokens (NFTs). Well-known NFTs such as Bored Ape Yacht Club and Axie Infinity belong to the ERC-721 standard, which describes how non-fungible tokens should be created and managed on the Ethereum blockchain.

Unlike ERC-20 tokens where each unit is equivalent, each unit of ERC-721 tokens is unique and non-interchangeable, making them an ideal choice for representing unique digital or real-world assets (such as artworks, real estate, collectibles, etc.). The earliest NFT CryptoPunk was not based on the ERC-721 standard, but on the ERC-20 standard. However, the emergence of CryptoPunk prompted the birth of ERC-721, which has become the cornerstone of many valuable applications such as NFTs.

Key components: tokenId and owner. TokenId is a unique identifier used to differentiate between different ERC-721 tokens, while owner is the address of the token owner. Under the ERC-721 standard, each token is distinct and unique, distinguished by the ID property, and each ID is associated with an owner.

Features and benefits: ERC-721 tokens are non-fungible, with each token being one-of-a-kind. This makes them well-suited for representing unique items or assets, such as artwork, collectibles, real estate, or other unique assets. This also makes them highly valuable in creating and trading digital art and other unique digital assets.

Limitations: Due to the non-fungible nature of ERC-721 tokens, they cannot effectively be used to represent interchangeable assets such as currency or shares, and lack liquidity advantages. They are indivisible and have poor composability, as you cannot own 0.5 of an ERC-721 token.

ERC-1155

ERC-1155 is a multi-instance token standard that combines the features of both ERC-20 and ERC-721, designed to handle multiple different types of tokens more efficiently and flexibly. In the previous ERC-20 and ERC-721 standards, a new smart contract was needed to deploy each different type of token. This meant that if you wanted to create a new token, you needed to deploy a new contract, which could result in duplicated code and expensive gas fees. Additionally, there may be complex interactions between different contracts.

ERC-1155 provides a way to manage multiple types of tokens in a single smart contract, where each token can be homogeneous (like ERC-20 tokens) or non-fungible (like ERC-721 tokens). For example, in a game, you could use ERC-1155 to create different types of weapons (non-fungible) like sticks, knives, and guns, while each weapon under each weapon type (non-fungible) would be homogeneous. Weapon 1 and Weapon 10 under the same weapon type (homogeneous) would be exactly the same, but knives and guns (non-fungible) would be different.

Key components: id, value, and owner. The id is a unique identifier used to differentiate between different ERC-1155 tokens, while value represents the number of tokens for a specific id, and owner is the address of the token owner. In the case of weapons, different weapon types represent different IDs, while the number of weapons under each weapon type (ID) is the value, and each weapon under each weapon type (value) is the same.

Characteristics and advantages: ERC-1155 tokens can simultaneously represent interchangeable and non-fungible assets, making them very useful in a range of applications. For example, a game may use ERC-1155 tokens to represent a player’s equipment type (non-fungible) and equipment quantity (fungible).

Limitations: While the flexibility of ERC-1155 tokens makes them useful in many situations, this flexibility also makes understanding and implementing ERC-1155 potentially more complex than ERC-20 or ERC-721, and they cannot represent partially exchangeable assets such as bonds or futures, and cannot be split into non-integer amounts, you cannot have 0.5 ERC-1155 tokens.

ERC-3525

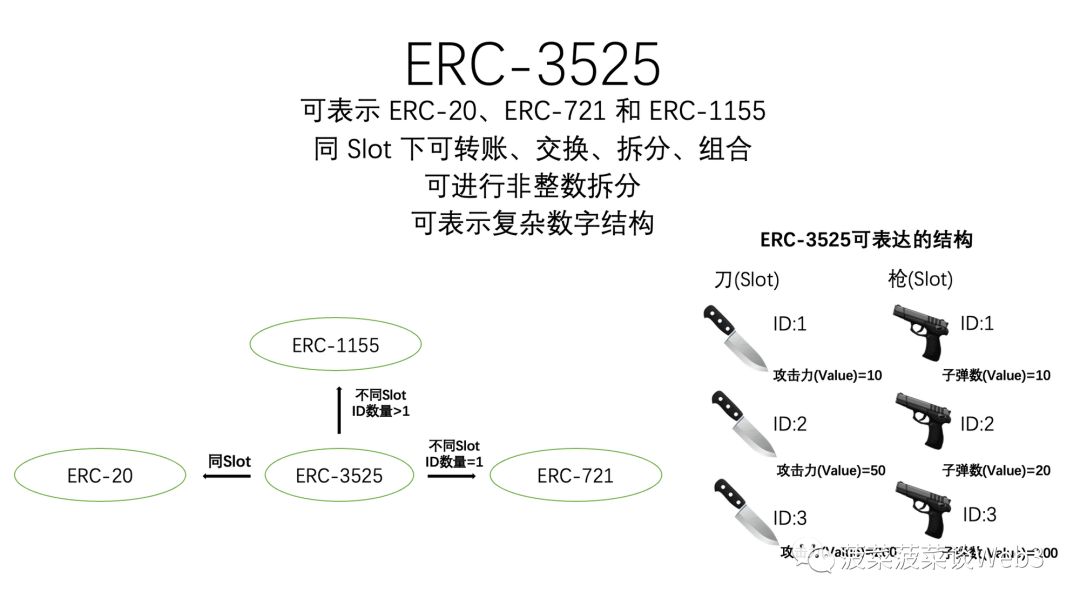

ERC-3525 is a semi-fungible token (SFT) standard that combines the characteristics of ERC-20, ERC-721, and ERC-1155. Compared to ERC-1155, it is more complex, but can be used to express and manage complex digital financial assets such as securities, bonds, options, futures, swaps, insurance policies, etc. Compared to other token standards, it has more composability. ERC-3525 represents a digital world modeling concept and can be understood from three levels: super NFT that can be split and combined, universal digital container, and visual smart contract.

Key components: id, value, Slot, and Address. Each SFT has an id property equivalent to ERC-721, allowing it to be identified as a globally unique entity, so SFT can be transferred and approved between addresses in a way compatible with ERC-721. In addition, each token contains a value attribute that represents the quantity nature of the token, similar to the “balance” attribute of ERC-20 tokens.

Address represents the address that owns Slot and ID. Each address can have any number and type of IDs and Slots. The distinguishing feature is the Slot attribute, and the value of different IDs with the same Slot can be transferred and exchanged, while the value of different Slots cannot be transferred and exchanged. A Slot can have many types of IDs, and different IDs can only have one Slot.

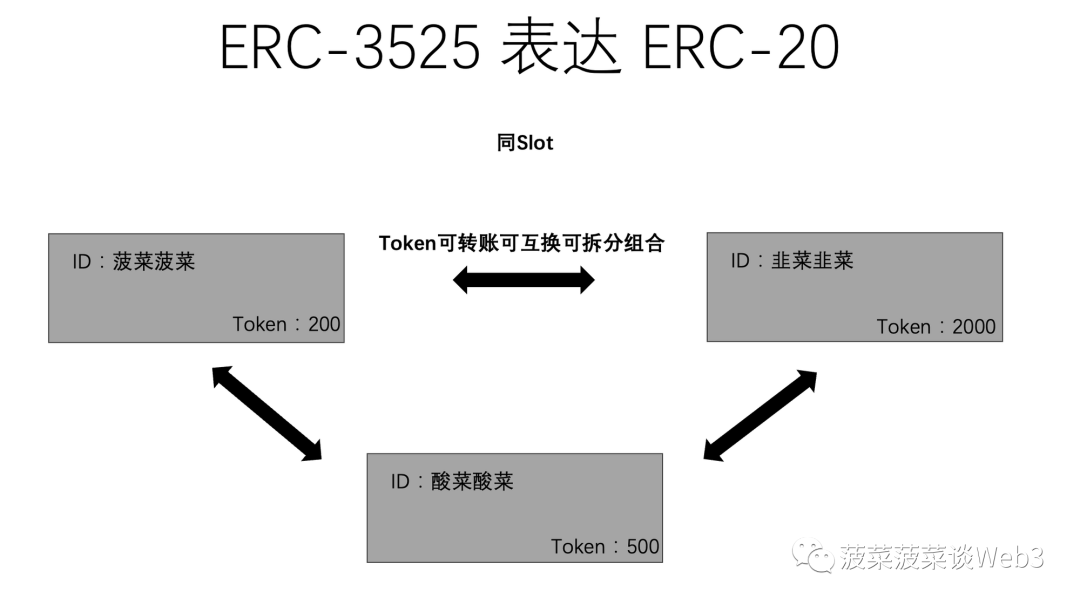

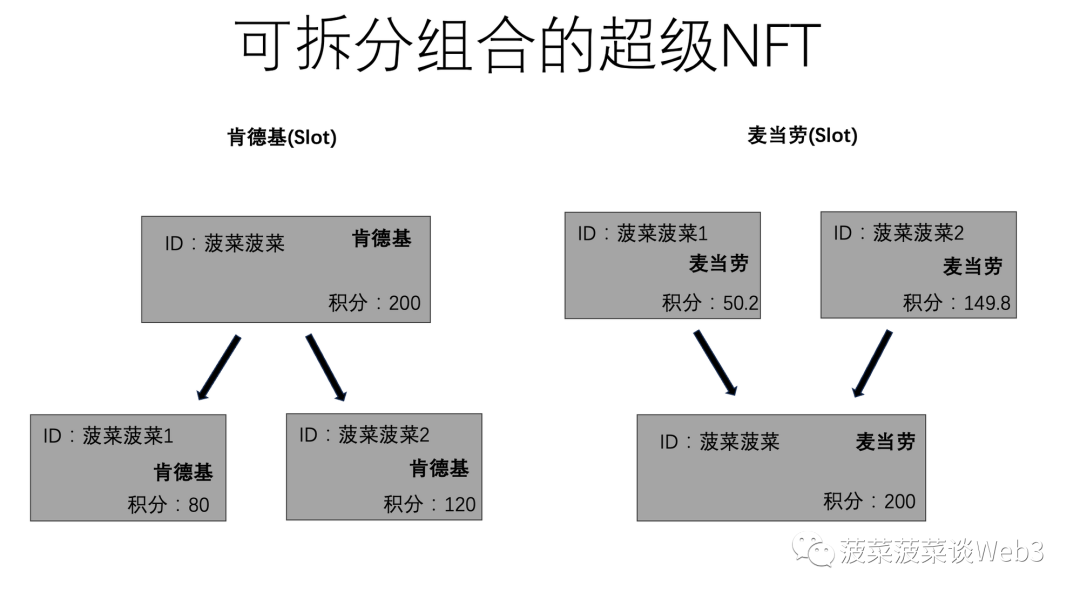

The focus of ERC-3525 is on Slot, which represents a classification. Under the same Slot, there will be many IDs. Although each ID is different and has its own value, different IDs under the same Slot can be considered the same and can be exchanged, combined, and split. Taking a membership card as an example, suppose the membership card has two Slots, KFC and McDonald’s, and each KFC and McDonald’s membership card has a different ID representing the membership card of different people, such as Satoshi Nakamoto’s card and V God’s card. Each person’s membership card has a Value to represent their points.

Using a membership card as an example, suppose the membership card has two slots for KFC and McDonald’s, and each KFC and McDonald’s membership card has a different ID representing different people’s membership cards such as Satoshi Nakamoto’s card and V God’s card, and each person’s membership card has a Value to represent their points.

So in the same slot, which is the KFC membership card, the points in Satoshi Nakamoto’s card and V God’s card are considered the same thing, Satoshi Nakamoto can transfer points from V God’s card, and Satoshi Nakamoto can also split the points in his own membership card into main card and sub card (two different IDs, arbitrarily assigned point Values), and can also merge the main card and sub card back together.

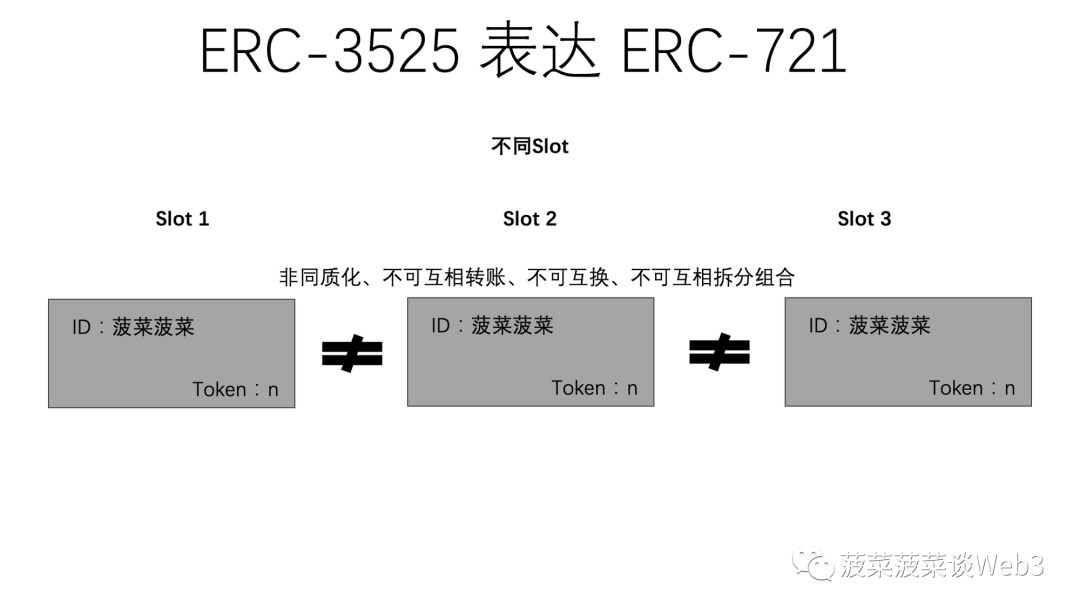

However, in different slots, KFC and McDonald’s, as two different companies, KFC’s points cannot be transferred to McDonald’s membership card, so naturally there is no transferability, exchangeability, and combinability between Value and ID.

Characteristics and advantages: Due to its more complex structure, ERC-3525 can be used to represent various complex digital structures such as securities, bonds, options, futures, swaps, insurance policies, membership cards, etc. In addition, because it is a semi-fungible token, each token can have its own characteristics and rules, making this standard very flexible and powerful. And because of the existence of slots, ERC-3525 can achieve transfer from ID to ID, just like Satoshi Nakamoto’s points card transferring points to V God’s points card, and also support non-integer splitting and combination.

Limitations: The complex structure of ERC-3525 results in a higher understanding threshold. Due to the existence of slots, there are more centralized features in the technical structure. The development difficulty is higher.

Understanding ERC-3525 as a digital world modeling idea from three levels

Due to its more complex structure compared to other token standards, ERC-3525, as a generic token standard, can create various complex token structures in the digital world through the combinability of its data structures, just like using Lego bricks to create various complex models in the real world. It can be said that ERC-3525 represents a digital world modeling idea. To understand ERC-3525 in depth, it can be understood from three aspects: super NFT that can be split and combined, universal digital container, and visual smart contract.

Super NFT with Separable and Combinable Features:

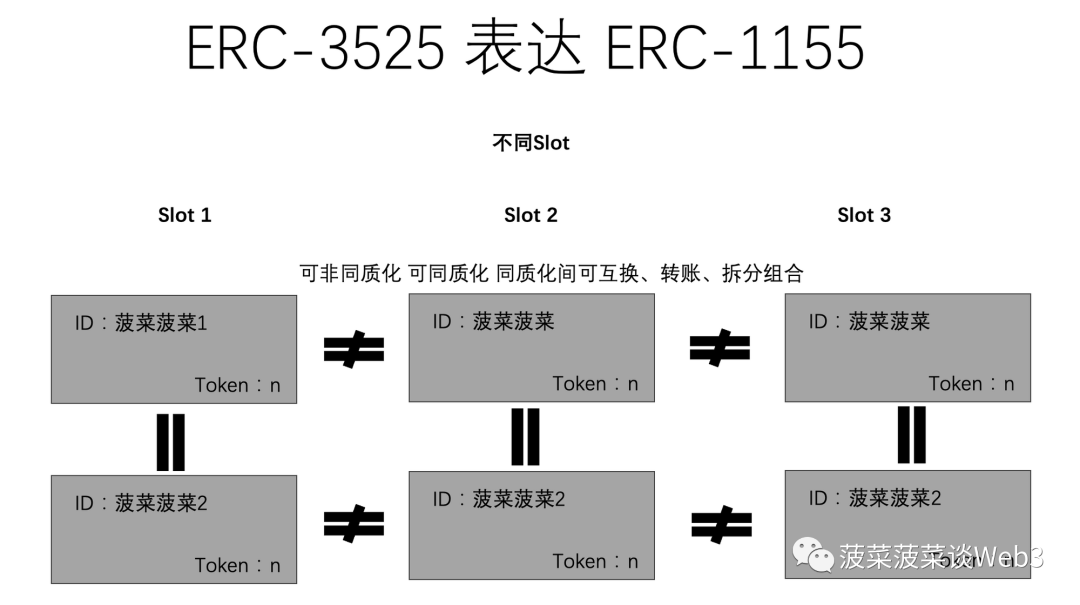

ERC-3525 can express three token standards, ERC-20, ERC-721, and ERC-1155, by only switching its attributes, for example:

To express ERC-20: Slot is the same, and Value under only one ID can represent homogeneous tokens.

To express ERC-721: Slot is different, and only one ID can represent non-homogeneous tokens.

To express ERC-1155: Slot is different, and multiple IDs with different values can represent multi-instance tokens.

However, ERC-3525 is not limited to this. On top of this, ERC-3525 can achieve the split of non-homogeneous tokens. For example, a boring ape can be truly split into several pieces rather than being fragmented into NFT through an additional contract. For most people who first learn about ERC-3525, the general understanding may be that ERC-3525 is a super NFT with separable and combinable features. There is no problem with this level of understanding, but this is only the tip of the iceberg and does not fully understand the greater potential of ERC-3525.

Universal Digital Container:

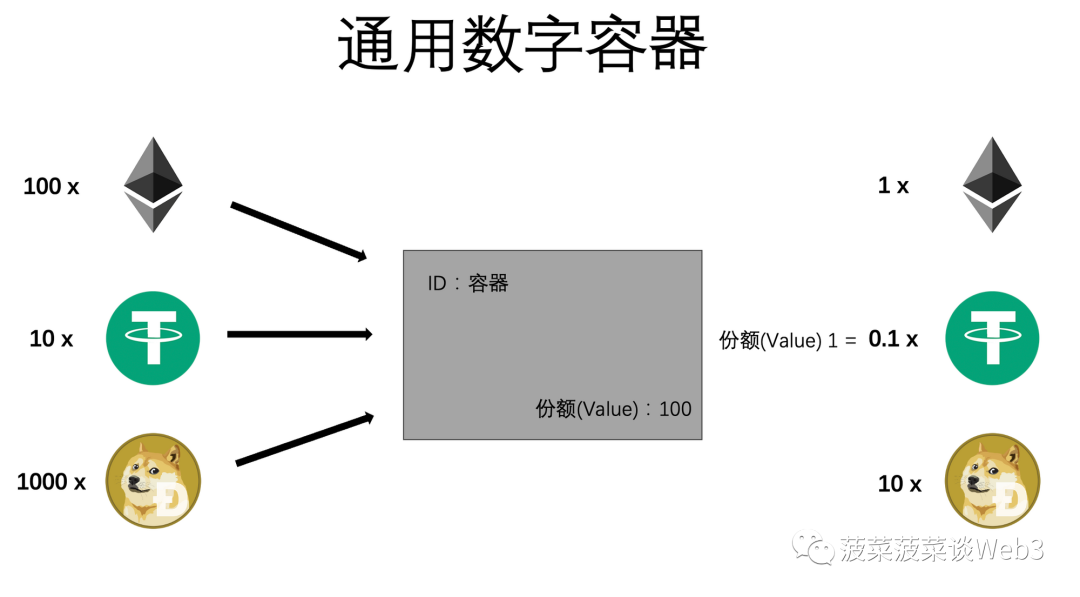

To understand that ERC-3525 is a universal digital container, it is necessary to understand that ERC-3525 is an account abstraction. As mentioned in the case of the membership card, ERC-3525 can realize the transfer between IDs. Its internal ID is essentially an account, which has the functions of receiving, storing, and sending, just like a basket filled with various digital assets. Since ERC-3525 is an abstract account, it means that we can separate and decouple the operation authority of an ID in a certain slot and grant it to other wallet addresses, not just the owner of this ERC-3525 smart contract.

The difference between ERC-3525’s account abstraction and ERC-4337’s account abstraction is that ERC-4337 decouples the signing authority and ownership of the smart contract wallet, allowing for custom signature methods such as traditional password-based wallet operations, while ERC-3525’s account abstraction still relies on EOA wallet accounts (wallets operated using a private key) for operation, and an ID can only receive assets under the same slot.

If we understand the ID of ERC-3525 as an account with receiving, storing, and sending functions, it means that it can serve as a container for digital assets, and any digital asset can be poured into this universal digital container as a solvent and become a uniform solution. At this point, the Value of this ID becomes a share of a basket of assets.

For example, in a slot, container A (ID: A) has 100 bitcoins and 10 ether poured into it. After bitcoin and ether are poured into the container as a solution, if the Value of container A is evenly divided into ten parts, then each split container will have the same 10 bitcoins and 1 ether.

At this point, if the container wants to combine with another container (100 Doge) with different components, the solution in the new container represents 10 bitcoins, 1 ether, and 100 Doge. Similarly, this container can continue to split and combine, and the solution inside (Value) represents the share of this basket of assets.

Understanding this layer can help you feel the magic of ERC-3525. With its complex data structure and flexible combinability, you can create countless complex token structures in the digital world, just like Russian nesting dolls that can be nested many layers deep in containers, which is very suitable for expressing some structured financial assets such as ABS, MBS, etc.

Visual Smart Contract:

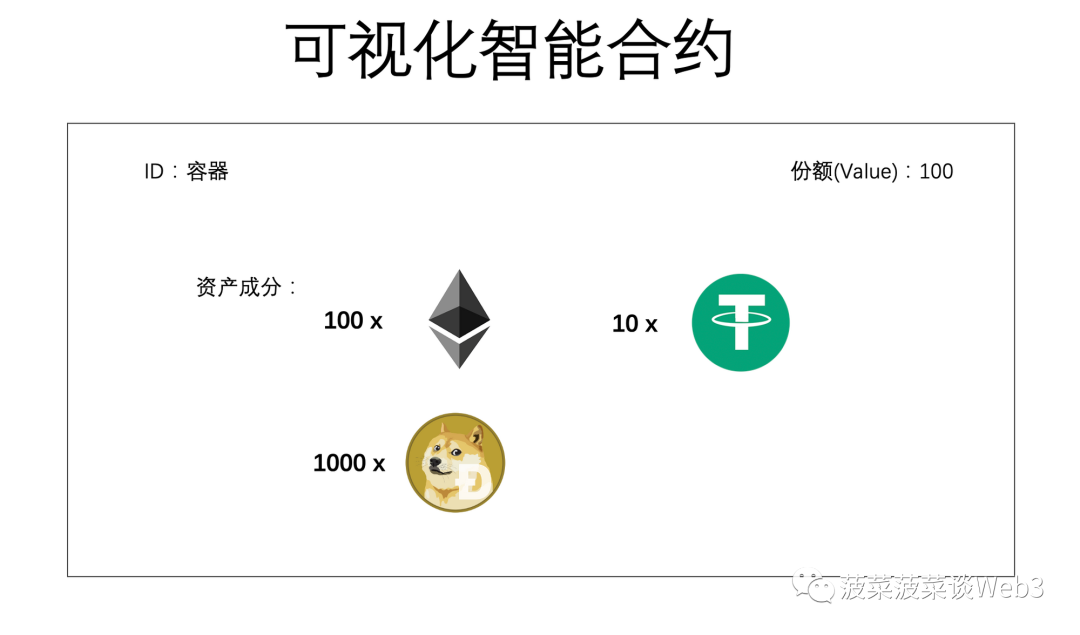

The meaning of “ERC-3525 as a visual smart contract” is not difficult to understand. Similarly, if we compare ERC-3525 to a container, it is like installing a real-time updated display screen on the container, which displays all the information content and changes in the container, such as what components the solution contains (which assets and what proportions). The visual characteristics make it easier to manage and more transparent.

Although it is just a visualization of a smart contract and seems very simple, the meaning behind it is not simple. If ERC-3525 technology existed and was widely used before 2008, perhaps the financial crisis would not have occurred. This can be traced back to one of the triggers of the financial crisis in 2008, which is the chaos of financial derivatives.

After the bursting of the Internet bubble, the United States opened a low-interest rate and loose monetary policy to stimulate the economy, and low-interest loans would cause more people to borrow money. If you have watched a movie called “The Big Short”, you should be impressed by a scene in the movie: a person can borrow money from a bank to buy a house without any collateral, even in the name of his dog. Why can such absurd situations occur? Are banks not afraid that these people will not repay the money? In fact, banks are really not afraid. This is all because of a financial derivative called MBS.

Mortgage-backed securities (MBS) are asset-backed securities whose income stream comes from a group of mortgage assets, such as residential or commercial mortgages. These loans are packaged and sold to special purpose entities (SPEs) by loan providers (such as banks), which then convert them into securities that can be sold to investors.

This mode of operation essentially packages a set of mortgage loans into a new financial product sold to investors. For banks, this operation can transfer the original loan risk, obtain cash by selling these packaged mortgage loans, and earn interest. Those loans rated as high risk, such as loans with no income and no collateral, are called subprime loans. This is why the 2008 financial crisis is called the “subprime crisis”, because many defaults of subprime loans led to the collapse of the MBS market.

Since mortgage loans can be packaged into financial assets, other loans (such as student loans, car loans, and credit card loans) can naturally be packaged into financial assets. These assets are usually called asset-backed securities (ABS). The underlying logic of returns of these derivatives such as MBS and ABS comes from the interest and principal repayment of the borrower. These derivatives seem to have high returns and have attracted a large number of investors, but problems have also followed.

In this model of risk transfer, banks only focus on increasing the number of loans, ignoring the importance of loan quality. Many high-risk subprime loans were packaged into ABS and MBS, and as ABS and MBS became popular, financial institutions even began to create more complex financial derivatives – debt-backed securities (CDO).

If ABS and MBS are financial assets packaged by many loans, then CDO is a financial asset packaged by ABS and MBS, forming more hierarchical financial products. The combination of assets of different qualities after packaging increased the diversity of the investment portfolio, and set different payment levels such as subordination (higher yield but first bear principal losses in the event of default) and priority (lower yield but relatively safer principal in the event of default). In theory, it can increase the stability of the investment portfolio as a whole and obtain a better Sharpe ratio (risk-return ratio).

However, this complex financial product makes it difficult for investors to understand its true risk, and the moral risk of rating agencies further exacerbates this problem. Some rating agencies rate assets that should belong to higher risk levels as low-risk levels in order to attract customers, which further increases risk.

In addition, insurance products such as credit default swaps (CDS) further insure, split, and repackage the different levels of CDO, and mix other assets such as CDS into the new CDO, which is called synthetic CDO. In the end, people have been completely unable to know which assets support the nested financial derivatives. Many subprime loans were mixed into many so-called low-risk financial derivatives, and distorted ratings allowed high-risk assets to be paired with extremely low premiums. After being packaged and sold to various brokers and investors, the leverage ratio of the entire financial system is increasing rapidly and becoming more and more precarious.

As the United States began to raise interest rates, the growth of loan interest rates caused many borrowers to begin defaulting. This problem was initially most obvious in the subprime loan market, but due to the fact that subprime loans were packaged in ABS, MBS and even CDO, this problem quickly spread throughout the financial market. Many seemingly high-level, low-risk financial derivatives suddenly exposed high default risk, and investors knew nothing about the true risk of these derivatives. The market’s confidence was severely hit, and there was a large-scale sell-off in the financial market, which was one of the main triggers of the 2008 financial crisis.

This situation is exactly caused by the disorderly, opaque, and overly complex structure of the financial market. However, the ERC-3525 visual smart contract can solve this problem. ERC-3525 can realize complex financial derivatives, such as nested ABS, MBS, and CDO. More importantly, its visualization feature can allow people to directly see the specific components included in these complex nested products, which is important for risk control.

Put in the context of 2008, even complex asset securitization products can calculate real-time objective ratings based on the yield and default rates of their underlying assets. This increase in transparency, combined with the automatic execution of blockchain smart contracts, improves the security and trust of transactions and prevents the accumulation of systemic risks.

If ERC-3525 had been applied before 2008, every investor and market participant could have a clear understanding of the specific situation of their investment, and perhaps the crisis would not have occurred. It can be seen that the visualization smart contract of ERC-3525 has such important significance for the asset management of real-world assets on the chain (RWA) in the future.

What ERC-3525 application areas are worth attention in the future?

As a super-NFT that can be split and combined, a universal digital container, and also with the feature of visual smart contract, the core competitiveness of ERC-3525 lies in its incredible flexibility and composability achieved through data structure transformation, as well as the ultimate transparency and execution convenience brought by the visualization function. This innovative structure endows ERC-3525 with great advantages in some fields, including but not limited to:

Real-World Assets (RWA):

For the definition of real-world assets (RWA), we can simply understand it as all assets outside the blockchain system, including but not limited to securities such as currency, stocks, bonds, commodities, and funds, as well as real estate, art and collectibles, agriculture, climate assets, and intangible assets (such as carbon credits and intellectual property).

According to Citibank’s latest research report “Money, Tokens, and Games”, up to $50 trillion of funds may flow into new forms of digital currency such as central bank digital currency (CBDC) and stablecoins by 2030, with about half of the funds based on blockchain’s distributed ledger technology. This prediction focuses on the continued innovation of law and technology, and Real-World Asset Tokenization (RWA) is seen as a key driving factor that will lead the blockchain industry into a market worth trillions of dollars. In fact, any asset that can be assigned value, whether it is wine or financial assets, can be tokenized, greatly improving liquidity and enabling global transactions through blockchain technology.

ERC-3525 has significant advantages in real-world securities assets. As a universal digital container, ERC-3525 can express almost all types of financial assets in the real world. Through the visual function of smart contracts, it can clearly reveal the internal structure of these financial assets, greatly improving their transparency and presenting risks intuitively.

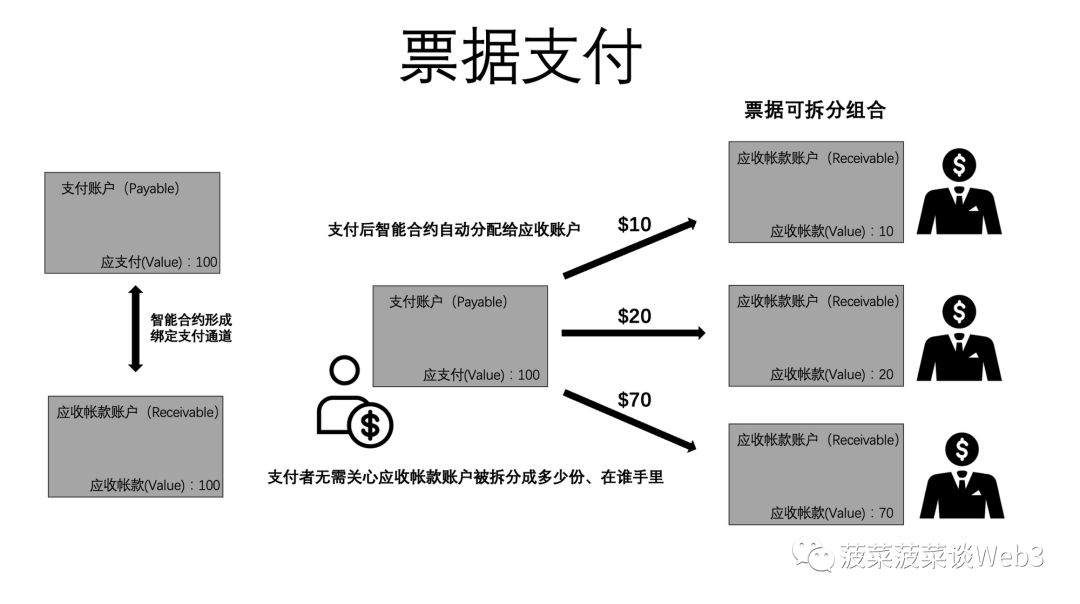

Moreover, in addition to traditional financial assets, ERC-3525 also demonstrates a new possibility in supply chain finance. With its unique properties, ERC-3525 can tokenize various assets in the supply chain, including raw materials, production equipment, inventory, accounts receivable, etc. Supply chain, as a major narrative of blockchain, spinach cites an actual application case to illustrate the subversive role of ERC-3525 in supply chain finance:

In supply chain finance, accounts receivable factoring is a common business model. It allows companies to sell their accounts receivable to third parties (usually factoring companies) at a certain discount price, thus obtaining necessary financing and improving their own cash flow situation. However, in the traditional supply chain finance model, this factoring service is usually only open to large companies and a few well-established small and medium-sized enterprises, and most small and medium-sized enterprises often find it difficult to enjoy this service.

The fundamental reason for this problem lies in the difficulty of verifying bills. Small and medium-sized enterprises generally lack sufficient credit support, and investors cannot conduct reasonable risk control on a large number of small and medium-sized enterprises. This leads to widespread financing problems for small and medium-sized enterprises in reality. If small and medium-sized enterprises cannot accept delayed payments on account, it is difficult for them to receive orders from large enterprises; but accepting orders from large enterprises will cause the enterprise’s liquidity to be tight, increasing the risk of cash flow disruption.

Imagine that if we tokenize bills in this scenario. Through ERC-3525, we can create a pair of accounts: payment account (Blockingyable) and receivable account (Receivable). These two accounts form a payment channel similar to quantum entanglement, as long as the buyer remits to the payment account, the funds will be automatically distributed to the receivable account through the smart contract. This means that no matter how many parts the receivable account is split into, and no matter who ends up with it, it will eventually be transferred to the receivable account according to the predetermined ratio, which greatly increases the liquidity and composability of supply chain finance factoring business.

In traditional supply chain finance factoring business, bill authenticity has always been a problem. In Western countries, bills are usually printed by each company themselves, rather than through a unified channel, making it difficult to distinguish the authenticity of bills. At the same time, it is also difficult for banks to use receivables bills as collateral, because each time collateral is required, two companies need to sign a contract to pledge the right to receive bill income, and default involves the transfer of payment objects. This greatly hinders most small and medium-sized enterprises from carrying out factoring business and financing.

However, the application of blockchain technology can change this situation. Through smart contracts, we can add a confirmation step (Confirm) during the billing process. Once confirmed, the bill will be generated and attached with the confirmation signatures of both parties. This ensures that the bill is generated in a state confirmed by both parties. Considering that the actual arrears period is equivalent to a form of loan provided by the seller to the buyer, if we can effectively solve the problem of bill authenticity, the seller can rely on the buyer’s credit to sell this receivable account to the factoring institution at a certain discount rate, and get the discounted amount.

For example, if a seller has a receivable account with a face value of 1 million yuan, and the factoring institution is willing to buy this account at a discount rate of 90%, the seller can immediately obtain a cash flow of 900,000 yuan without waiting for the buyer’s payment. This process essentially accelerates the flow of cash flow by transferring credit risk, which can be achieved through ERC-3525 and blockchain technology.

With the traceability and transparency of blockchain, the automatic execution and verification of smart contracts, and the convenience of ERC-3525 execution, we can see that ERC-3525 has significant advantages in traditional financial asset tokenization, especially in supply chain finance. However, in the RWA field, the widespread application of blockchain technology requires the support of sovereign governments, regulated financial institutions, and large corporations, but this also conforms to the relatively centralized characteristics of ERC-3525 in the technical structure. With the continuous updating and improvement of middleware facilities such as prediction machines, the on-chain of real-world assets will be a big narrative for ERC-3525 in the future, which is worthy of continuous attention.

Virtual assets or goods:

In addition to representing financial assets, ERC-3525 can also be used to represent virtual digital goods or items, such as virtual land, upgradable/mergeable game items, virtual membership cards, gift cards, lottery tickets, etc. Among them, virtual land, game props, and membership cards are areas worth paying attention to. For existing game props and virtual land systems, ERC-3525 shows higher possibilities and flexibility, and ERC-3525 is backward compatible with the ERC-721 standard. This means that all protocols, platforms, and wallets that support the ERC-721 standard integrated with ERC-3525 will be relatively easy. In the future, ERC-3525 has the potential to show higher playability in the combination of games and blockchain.

With the launch of the Starbucks Odyssey Plan, the combination of customer loyalty programs and Web3 has attracted widespread attention. This can be understood as a points membership card system, and Starbucks has a globally leading customer loyalty program, with tens of millions of active members in the United States alone. It is worth noting that membership cards may become a key scenario for Mass Adoption of Web3, which will help attract a large number of users into the world of Web3.

From the earlier cases of KFC and McDonald’s, we can see that the ERC-3525 token standard has significant advantages in customer loyalty programs. It can achieve collection, transfer, and storage operations from ID to ID, and its Value can well represent the point value in the membership card ID. Therefore, ERC-3525 has high potential in this application scenario and may play a greater potential than other token standards in the future.

Social, identity fields, and tokenized accounts:

As ERC-3525 is composable, it can express more data structures, making it more advantageous to use semi-fungible tokens (SFT) to express social networks in the current Web3 social field, such as the Lens protocol, than non-fungible tokens (NFT). In addition, using ERC-3525 to achieve soul-bound tokens (SBT) can also express more attributes, such as quantitatively representing some specific data in SBT, such as a person’s contribution in a certain event.

Additionally, ERC-3525, as an account abstraction and digital container, can itself be a “wallet”, so in addition to having the functions of a normal blockchain wallet, ERC-3525 also leaves room for other more imaginative innovations.

Summary

As a separable and combinable super NFT, a universal digital asset container, and a visual smart contract, the positioning of ERC-3525 is not to solve the problem of value creation, but to solve the problem of value packaging. Digital assets can grow a dynamic, rich information interface, can be fragmented, merged, packaged, combined and programmed.

ERC-3525 shows significant advantages in the future trend of Web3. Whether it is real-world assets (RWA), customer loyalty programs, or gaming and other fields, ERC-3525 has significant potential. Especially in the subdivided field of real-world assets such as supply chain finance, ERC-3525 has overwhelming advantages over other standards. These development directions are worth our continuous attention.

However, ERC-3525 still faces some challenges and resistance:

1. The high complexity leads to a high cognitive threshold, which hinders people’s general understanding and acceptance of ERC-3525.

2. The development difficulty of ERC-3525 is higher than that of ERC-20, ERC-721, and ERC-1155, and it has higher requirements for entrepreneurial teams.

3. The application scenarios of ERC-3525 may involve sovereign governments and centralized guarantee institutions, belong to the semi-centralized zone, and may conflict with the absolute decentralization spirit, and the impact on the values of the blockchain world is still unknown.

In any case, it is precisely because ERC-3525 has not yet attracted market attention and is extremely promising that makes it more worthy of our close attention. We look forward to ERC-3525 playing an important role in the Mass adoption of Web3 in the future.

Reference:

[1] https://icg.citi.com/icghome/what-we-think/citigps/insights/money-tokens-and-games

[2] https://eips.ethereum.org/EIPS/eip-3525

[3] https://mp.weixin.qq.com/s/cf8_oDVGBSwXYqEWYmv8uA

[4]https://research.web3caff.com/en/archives/1996

[5]https://sftlabs.io/2022/09/27/everything-about-fungible-semi-fungible-non-fungible-tokens/

[6]https://www.binance.com/en/news/top/7221255

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!