Original author: DigiFT Translator: Planet Daily

In 2017, the Ethereum ERC20 token standard brought about the explosion of on-chain financing-ICO, and based on the ERC721 encrypted cat game blocking network, developers imagined the infinite possibilities of on-chain assets. The concept of the earliest real-world assets (RWA) was also popularized at that time in the form of STO (Security Token Offering).

Every change in financial infrastructure in history is based on changes in accounting methods; from the earliest paper securities sold at the counter, to electronic bookkeeping, to tokenization and chaining, the expression of financial assets has constantly evolved towards efficiency, transparency, and credibility.

Initially, due to the imperfect legal framework and the lack of on-chain financial infrastructure, the STO hype came to an end. DeFi in 2020 has built a set of almost complete on-chain financial infrastructure, and issuance, trading, and borrowing can be efficiently executed on the chain, bringing development impetus for the subsequent entry of traditional finance.

- Who can create trustworthy digital assets in the blockchain world?

- Multichain: Some cross-chain routing is currently unavailable due to force majeure, and the restoration time is unknown.

- Meeting minutes show that Federal Reserve officials have differing opinions on whether to pause rate hikes in June.

Outside the technical level, the progress of laws and regulations has brought the possibility of large-scale asset chaining, such as Singapore, Hong Kong and other governments exploring the issuance of relevant licenses.

Driven by both technology and law, a token on the blockchain can represent real-world assets. Just in the current world of encrypted assets, the yield of on-chain native asset returns has dropped significantly in a bear market, and the pledge yield of mainstream lending platforms for stable coins is only 2.5%, far lower than the “risk-free return” of US Treasury bonds; when on-chain assets are no longer attractive, investors begin to explore real-world assets.

US Treasury bonds have the best liquidity and “widely believed” lowest risk, close to a “risk-free” annualized return of 5%, attracting a large number of investors. Cryptocurrency holders also expect to participate, not only for their returns, but also to hedge against the risks of encrypted assets.

Both the old and new worlds have the motivation to understand each other. On-chain national debt products have emerged as experimental fields. This article explores the current five on-chain national debt projects on the market to analyze their solutions, legal frameworks, current status, and potential risks.

Development Motivation: Why do we need on-chain bonds?

Before discussing these solutions, we need to first understand the “why” of development motivation; the solution comes from the combination of technology and law, which requires both technological advantages and people motivated to promote the design of solutions and improve related regulations.

We believe that both traditional finance and web3 finance have the motivation to promote the development of on-chain assets.

1. Why do traditional finance investors want on-chain tokenized assets?

Asset security: After experiencing the bankruptcy of multiple banks/financial institutions, the black box of the traditional financial system is no longer widely trusted; the self-custody property of encrypted assets guarantees control over assets as long as the private key is held, making investors more likely to hold tokenized encrypted assets.

Asset flexibility: After tokenization on the chain, assets have penetration and can seamlessly integrate with other financial applications, providing users with a better user experience, reducing usage costs, typically for lending, pledging, trading, and even implementing programmable assets through certain smart contract designs;

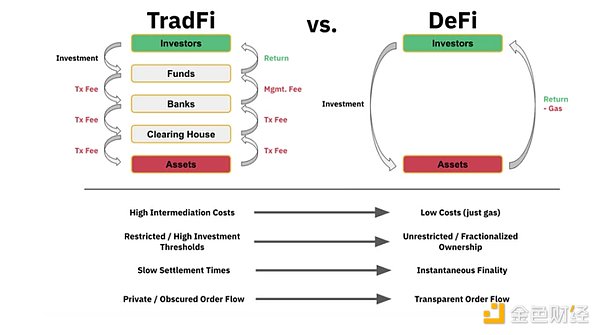

Transaction costs: Transactions and lending are implemented through on-chain smart contracts without intermediaries, and assets are directly cleared and settled on the chain based on algorithms, without the cumbersome T+N settlement process caused by complex traditional accounting methods and ledger asynchrony.

Globalization: Due to geographical restrictions, some investors cannot purchase the assets they want; through the DeFi infrastructure, investors have the opportunity to easily access global assets.

Source: Binance research

2. Why do web3 investors want to buy real-world assets?

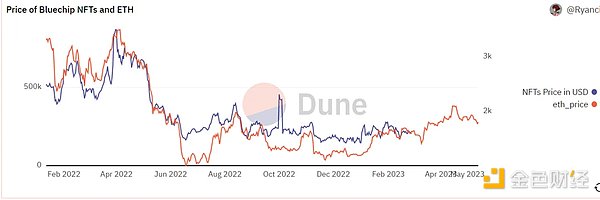

Asset diversification: Although there are many types of encrypted assets, from public chain tokens, governance tokens, utility tokens to NFT art, etc., all assets are essentially highly correlated and are the same type of assets from an economic perspective. Taking NFT as an example, BAYC, Cryptopunk and other projects have attracted a lot of attention from outside the encrypted asset circle, and even many celebrities have participated in them, but we have done a simple data analysis, comparing the prices of the top five blue-chip NFTs (USD valuation) with the Ethereum price, and found that they are still highly correlated.

Source: Dune.com

Cryptocurrency investors also hope to diversify their risks and gain some returns outside of the crypto world. Real-world assets are relatively more diversified, have sound compliance, investor protection tools, and information disclosure requirements, which are attractive investment targets for crypto investors and can achieve asset hedging and portfolio allocation.

Development status

The projects studied in this article include: Matrixdock sTBT, Maple Finance, Ondo Finance OUSG, T protocol and Openeden.

Among them, Matrixdock’s sTBT and Ondo Finance’s OUSG will go live in January 2023, with national debt assets of $71.8 million (67 addresses participating) and $118.4 million respectively. Maple Finance’s Cash management pool and Openeden announced their product launch in May 2023, and Maple Finance has not purchased it for the time being. Openeden has $1.7 million in assets and 5 addresses participating. The products offered by the four platforms require investors to go through KYC and prove themselves as qualified investors/institutions, with a minimum single purchase of at least 100000 USDC.

T protocol went live in March 2023, and its token underlying asset is MatrixDock’s sTBT. Through token packaging to remove whitelist restrictions, it realizes permissionless national debt tokens and embeds them in several DeFi protocols. Currently, there are approximately $6.8 million in national debt assets, with nearly 300 holding addresses. The relevant data is as of May 11, 2023.

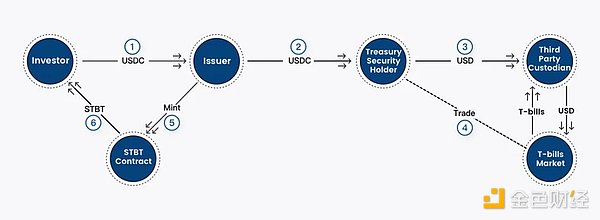

Except for T protocol, the process of other products is divided into on-chain and off-chain parts, where the participating components include:

-

The issuer, generally the entity established by the project party and deployed on the chain for smart contracts. Investors invest USDC, and the contract issues corresponding national debt tokens according to the rules and set prices.

-

On-chain custody agency, the USDC of investors will be held by the on-chain custody agency.

-

Deposit and withdrawal channels, the issuer collects USDC from investors and exchanges it for USD to the corresponding custodian.

-

National debt management, which generally needs to be a compliant fund sponsor or SPV, trades bonds with investors’ funds on the public market.

-

Third-party custody, the management of national debt by the management agency is operated in the account of a licensed custody institution of a third party.

Due to the combination of on-chain and off-chain aspects, on-chain national debt products still involve multiple parties and friction in custodianship, deposits and withdrawals, and other steps in the off-chain process that are consistent with traditional financial processes.

On-Chain Treasury Bond Case 1: MatrixDock sTBT – Attempt at Institutional-Grade U.S. Bond On-Chain

With the exception of T protocol, the user experience flow on the platform is generally the same. Taking MatrixDock as an example, the subscription process is as follows:

-

Investors need to pass KYC and be verified as qualified investors; the platform will add the wallet address of the certified investor to the whitelist, and only whitelist addresses can hold and operate sTBT tokens.

-

Investors send USDC to the platform’s smart contract, usually more than 100,000 USDC.

-

The USDC will be held in a custody wallet and exchanged for USD to a bank account through deposit and withdrawal channels.

-

The management party publicly trades treasury bonds, which are held in custody by a third-party institution.

-

After the investor purchases, the platform needs 3 working days of New York banks to carry out a series of operations, and finally sends the confirmed sTBT quantity to the investor’s wallet.

Source: MatrixDock sTBT whiteBlockingper

Relatively speaking, the subscription process takes three days, which is not user-friendly. sTBT adopts the ERC 1400 standard to achieve token rebasing, with each sTBT pegged to 1 US dollar, and earnings realized through rebasing (increased token balance).

Pegging to 1 US dollar allows sTBT to trade on Curve with other stablecoins, with low slippage and fees; whitelist investors can also trade sTBT directly on Curve to obtain timely liquidity; providing liquidity on Curve can earn Crv token rewards and fee income.

sTBT will increase the corresponding sTBT token quantity in the user’s wallet at 3 PM on each New York bank workday based on the day’s treasury bond market earnings. For example, if there are 100 sTBT in the user’s wallet, corresponding to $100, and the daily earnings are 1%, after the rebase process, there will be 101 sTBT in the user’s wallet, corresponding to $101.

If the fair price of the government bond market falls on the day, the user’s assets will suffer losses, and the sTBT balance in the user’s wallet will not decrease. The fair value of actual secondary market transactions will fall. Rebase will continue to occur until the fair value returns.

On-chain Government Bond Case 2: T protocol – Unlicensed On-chain Government Bond

T protocol is an unlicensed on-chain government bond project based on MatrixDock sTBT, issuing two tokens:

-

TBT, which is an encapsulation of sTBT with a rebase mechanism to anchor TBT’s price at $1, enabling transactions on Curve.

-

wTBT, which is a non-rebasing ERC 20 standard token that can be exchanged bidirectionally with TBT; the exchange rate between wTBT and TBT increases as the quantity of TBT rebase increases.

TBT can be traded on the secondary market and can also be directly minted with USDC, and the corresponding quantity of TBT can be sent to investors immediately without waiting for the sTBT minting time. T protocol charges a relatively high minting fee to cover the interest cost of sTBT minting during this period.

wTBT can be sent to Optimism Rollup via cross-chain bridge and has liquidity on the decentralized exchange Velodrome. Providing liquidity can simultaneously obtain Velodrome’s platform token rewards and transaction fee income.

Future Development Trends and Possibilities

Token Standard

While researching existing on-chain government bond projects, we noticed that the token standard for interest-bearing bonds is not yet perfect. Most projects use the most basic ERC 20 token and determine the price of the bond token through the oracle or directly feeding the contract. The ERC 20 standard is compatible with lending protocols and pledge protocols, as long as accurate price parameters are fed in.

However, there are difficulties in building a secondary market. On-chain AMMs are tailored for specific scenarios. For bonds, the relative price is stable, but the price still fluctuates and periodically has dividends or interest. Traditional bond markets use an order book model, where orders are concentrated near the current price, and traders and market makers can quickly react to the market. However, the order book model is not suitable for on-chain due to the characteristics of the blockchain, and various AMMs have their own trade-offs.

For bond tokens, the slippage is too high for Uniswap V2; while the liquidity concentration of Uniswap V3 can reduce slippage, in extreme market conditions, large price fluctuations can easily result in out-of-range trading and liquidity loss; Curve requires token prices to be anchored 1:1, but to trade on Curve, Matrixdock sTBT adopts a complex rebase mechanism to increase the complexity of the product.

DoDo’s PMM is relatively appropriate, but external oracle support is required and a price discovery mechanism cannot be implemented.

AMM is more suitable for the blockchain scene, and to adapt to AMM’s implementation of secondary market transactions, new token standards may be required. Among them, Maple Finance has designed ERC 2222, the Fund Distribution Token (FDT), which is an extension of the ERC 20 token standard, enabling token holders to receive future cash flows.

RWA Public Chain

RWA’s special asset properties require specific oracles, data services, token standards, and on-chain identity systems. Current mainstream blockchain platforms cannot provide related entities and services, and public chain/Layer 2 infrastructure related to RWA will also be one of the future development directions.

Convergence of Compliance Assets and DeFi

In the aforementioned on-chain national debt platform, Ondo Finance has designed the lending platform Flux Finance to realize the lending of national debt tokens OUSG. OUSG holders need to pass KYC and qualified investor verification to join the whitelist, while the provider of stablecoin liquidity can be without permission. Flux Finance is managed by another overseas entity and is separate from Ondo Finance’s legal entity.

MatrixDock’s sTBT combined with Curve, but direct purchase of sTBT still requires KYC to join the whitelist. Compared with the current issuance of over 70M sTBT, the daily trading volume on Curve is only a few thousand dollars.

T protocol directly takes the permissionless route and can arbitrarily convert national debt tokens into other forms of tokens, thereby embedding them in various DeFi applications.

Financial institutions are highly regulated. For compliant asset issuers, complete legal processes are required for each additional product issuance and new business line development. This is also the reason why it is difficult to promote compliant products:

-

Suspicions about the availability and reliability of public chains as financial infrastructure

-

How to divide new protocols such as AMM and lending agreements into existing regulatory frameworks

-

Clarification of relevant responsible parties

Conclusion

From physical assets, to digitalization, to tokenization, financial assets will always evolve towards higher efficiency and lower costs. The world of crypto has seen countless innovations due to its open nature, with Ethereum being the largest innovation experiment. However, it is precisely because of its open nature that the road to RWA is long, from technological innovation to business model exploration to communication with regulators. Even the electronicization of stocks took decades. Currently, the on-chain RWA market is only worth hundreds of millions, compared to the trillions of dollars in traditional finance, the $30 trillion US government bond market, there is still great room for development. While DigiFT is exploring its own development path, it also looks forward to the promotion of RWA infrastructure and laws and regulations, and will continue to pay attention to the progress made by project parties and developers in this regard.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!